An Insurance claims adjuster is an insurance professional tasked with investigating and evaluating insurance claims to determine the insurer’s liability. They engage with claimants and witnesses, examining records and property damage while compiling detailed reports. This role serves as an intermediary between policyholders and insurers, ensuring fair claim resolutions.

Claims adjusters can work for insurance companies or operate independently, often requiring specific licensing and ongoing education. While the position can be stressful, given its complexities and emotional negotiations, it is pivotal in assisting those facing losses. Explore further to uncover insights on their roles, responsibilities, and essential strategies.

Key Takeaways

- A claims adjuster investigates insurance claims to determine the insurer’s liability and facilitates fair settlements for policyholders.

- They handle property and liability claims by assessing damages, gathering evidence, and interviewing involved parties.

- Claims adjusters typically work for insurance companies and may require licensing and ongoing education to operate legally.

- Their average salary in the U.S. is around $61,465 annually, with potential for bonuses based on performance and claim complexity.

- Unlike public adjusters, claims adjusters represent the interests of insurance companies, focusing on validating claims rather than advocating for policyholders.

What Is A Claims Adjuster?

A claims adjuster is a professional responsible for investigating insurance claims to accurately assess the extent of an insurance company’s liability, often requiring them to engage with claimants, witnesses, and relevant records to inform their evaluations.

This role is essential in the insurance industry, as it directly impacts the fair and timely resolution of claims, ensuring that both the insurer’s interests and the rights of the insured are upheld.

Claims adjusters typically handle two main types of claims: property claims, which involve damage to structures, and liability claims, which pertain to personal injuries or damage to third-party property. To effectively evaluate these claims, adjusters conduct thorough investigations, which include interviewing the claimant and witnesses, reviewing pertinent records such as police and medical reports, and inspecting the damaged property or site.

There are two primary pathways for claims adjusters; they may be employed directly by insurance companies or operate as freelance adjusters contracted to manage specific claims. Regardless of their employment status, claims adjusters must adhere to state regulations, which may include obtaining a license, completing a pre-license course, and participating in ongoing education.

The demand for claims adjusters remains stable, even during economic downturns, making it a reliable career choice. By understanding the important responsibilities and requirements of a claims adjuster, individuals can appreciate the crucial role these professionals play in the insurance landscape, fostering a sense of security and community among policyholders.

Understanding The Role Of Claims Adjusters

Understanding the role of a claims adjuster involves recognizing their critical function in evaluating and validating insurance claims, ensuring that settlements are both equitable and aligned with the terms of the policy. Claims adjusters act as intermediaries between policyholders and insurance companies, conducting thorough investigations to substantiate claims related to various incidents, including personal injury and property damage.

In the case of property damage claims, the adjuster’s responsibilities entail a systematic examination of the situation. This includes inspecting the physical damage, reviewing relevant police reports, and engaging with witnesses and property owners to gather extensive evidence. For instance, if a homeowner submits a claim due to a fallen tree, the claims adjuster would assess the extent of the damage firsthand, interview the homeowner and any witnesses, and compile all findings into a detailed report.

This meticulous documentation is essential for determining the insurer’s potential liability. The adjuster’s analysis culminates in recommendations regarding the appropriate settlement amount, which reflects the actual costs of repairs and the policy’s coverage limits. However, it is important to note that claims adjusters may sometimes advocate for lower settlements, emphasizing the need for policyholders to be well-informed and prepared to negotiate.

Insurance Claims Adjuster Duties & Responsibilities

As a claims adjuster, your duties and responsibilities revolve around investigating insurance claims to determine the extent of the insurance company’s liability. This can involve reviewing police reports, conducting interviews with involved parties, inspecting property damage, and analyzing medical records. Your role is vital in determining the validity of claims and guaranteeing that policyholders receive fair and timely settlements.

Additionally, you will need to communicate effectively with policyholders, claimants, and other relevant parties to explain the claims process and answer any questions they may have. You must also stay up-to-date on insurance laws and regulations to guarantee compliance and accuracy in your claims handling.

Overall, your role as a claims adjuster is essential in providing policyholders with peace of mind and helping them recover from unexpected events. Your attention to detail, empathy, and professionalism are key in building trust and fostering a sense of belonging within the insurance community.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

What Does An Insurance Adjuster Do?

Insurance adjusters assess various types of claims, including insurance claims resulting from car accidents. Below are the steps adjusters typically take when investigating a car insurance claim for vehicle damage, although the exact steps may vary by insurer:

Review claim details & your policy: The adjuster assigned to your claim will first review the details of the accident/loss you submitted with your claim. They’ll also review your policy to determine which of your coverages may apply to your claim. Interview those involved: The adjuster will collect recorded statements from people involved in the loss, such as drivers, passengers, and witnesses.

They may also review the scene of the accident, police reports, or video footage of the loss, along with any other information related to the loss. Go over your options: If the adjuster determines that the damage is covered, they’ll go over your options with you. Typically, you can decide to move forward with repairs or get an inspection first to determine how much repairs will cost. For an inspection, your adjuster will coordinate the inspection of your vehicle and write up a repair estimate.

You can then choose to either have your adjuster set up repairs or you can take the claim payout and set up repairs yourself. If your vehicle is totaled, your insurer will pay you the actual cash value of the vehicle, minus your deductible.

Claims Adjusters VS. Public Adjusters

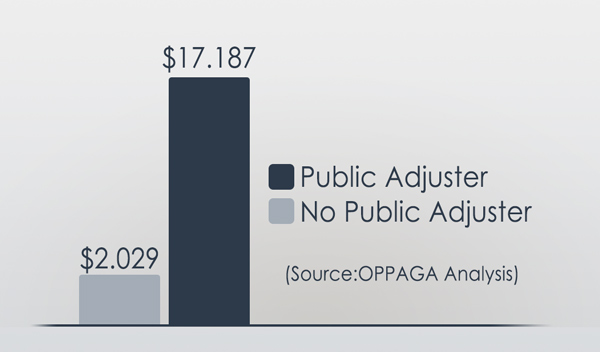

The distinction between claims adjusters and public adjusters lies primarily in their representation and interests, with claims adjusters typically working on behalf of insurance companies to evaluate claims, while public adjusters advocate for policyholders, ensuring that their clients receive fair compensation. This fundamental difference shapes their roles, responsibilities, and the overall dynamics of the claims process.

Claims adjusters are employed by insurance companies and are tasked with determining the validity and extent of claims made by policyholders. Their primary objective is to protect the insurer’s financial interests, which can sometimes lead to disputes over claim amounts and coverage.

They utilize a combination of investigative techniques and industry knowledge to establish the appropriate compensation, often relying on guidelines set by the insurance provider. In contrast, public adjusters operate independently, representing the policyholder’s interests. They possess a deep understanding of insurance policies and claims processes, enabling them to negotiate effectively with insurance companies.

Public adjusters often work on a contingency basis, which means their fees are contingent upon the successful settlement of claims, aligning their incentives with those of the policyholder. This alignment fosters a more collaborative approach, allowing for greater advocacy in pursuing fair compensation.

Working With Insurance Claims Adjusters

Steering the claims process involves a strategic approach when working with a claims adjuster, who, despite their role as an insurance representative, plays a notable part in determining the outcome of your claim. Understanding the nature of this relationship is essential, as claims adjusters are primarily motivated by the interests of the insurance company, which may not align with your own.

To effectively collaborate with a claims adjuster, it is advisable to meticulously document your losses. Creating a thorough home inventory, supplemented by photographs and videos, guarantees that you have tangible evidence of your belongings and their condition prior to the incident. This preparation not only strengthens your position but also provides the adjuster with a clear understanding of your claim’s scope.

Furthermore, obtaining independent estimates for repairs is vital. This allows you to present informed, competitive figures that can counter any lower estimates provided by the adjuster. Engaging in diligent research on repair costs and local service providers can empower you during negotiations.

Considering the potential conflict of interest, you might also explore hiring your own independent claims adjuster. This professional will advocate for your interests, assuring that you receive a fair settlement based on a thorough assessment of your claim. Ultimately, a proactive and well-informed approach when working with a claims adjuster can greatly influence the outcome of your claim, fostering a sense of security and support during a challenging time.

Does An Insurance Adjuster Get Paid Well?

Evaluating the compensation of insurance adjusters reveals a nuanced landscape influenced by factors like experience, workload, and the complexity of claims handled. According to Indeed.com, the average salary for a claims adjuster in the U.S. is approximately $61,465 per year. However, this figure is only a starting point, as actual earnings can vary considerably based on the number of claims an adjuster manages concurrently and the specific demands of those claims.

Insurance adjusters often operate within a variable pay structure that can lead to substantial earnings, especially for those who are seasoned professionals or handle complex claims. Some estimates suggest that skilled adjusters can earn thousands of dollars per week, particularly in roles that involve high-stakes negotiations and intricate case evaluations. Consequently, adjusters who excel in their roles and manage their caseloads effectively may find themselves financially rewarded in a manner that reflects their expertise and dedication.

Moreover, the potential for bonuses or commissions further enhances the overall compensation package for many adjusters. This performance-driven aspect of the role can serve as an incentive for individuals looking to maximize their earnings. Therefore, while the base salary provides a foundational understanding of compensation, the real financial picture is often more favorable for those who embrace the demands and intricacies of the profession. Ultimately, a career as an insurance adjuster can be financially rewarding for those who are committed to maneuvering the complexities of claims management.

Is Being An Insurance Adjuster A Stressful Job?

Insurance adjusters often encounter a significant level of stress due to the dual demands of managing complex claims and negotiating with emotionally charged individuals affected by losses. The role requires a delicate balance of analytical skills and interpersonal communication, which can be particularly challenging in high-stakes situations. Adjusters must navigate intricate policy details while simultaneously addressing the concerns and emotions of claimants who may be experiencing financial hardship or personal trauma.

The unpredictable nature of claims can contribute to heightened stress levels, as adjusters are tasked with evaluating damages, investigating circumstances, and determining liability—all within tight deadlines. The pressure to deliver timely and fair resolutions can lead to feelings of overwhelm, especially when dealing with multiple claims simultaneously. In addition, the potential for disputes or dissatisfaction from policyholders adds an additional layer of complexity to the role.

Despite these stressors, many adjusters find fulfillment in their work. The ability to help individuals through difficult times and provide clarity amidst confusion can be rewarding. Additionally, the flexibility inherent in the job allows for a degree of autonomy, which can mitigate some stress. However, it is essential for individuals considering this career path to recognize the emotional toll it can take and to develop effective coping strategies. Ultimately, while the role of an insurance adjuster can be stressful, it also offers opportunities for personal growth and professional satisfaction for those who thrive in dynamic environments.

How Can I Negotiate With an Insurance Adjustor?

Negotiating with an insurance adjuster requires a strategic approach that emphasizes thorough preparation, including detailed documentation of the claim and an understanding of policy terms.

To effectively advocate for a fair settlement, policyholders should consider the following steps:

Document Everything: Maintain a detailed record of all items lost or damaged. This should include photographs, videos, and detailed descriptions. A home inventory will serve as a critical piece of evidence to substantiate your claim.

Gather Repair Estimates: Obtain your own estimates for repairs from licensed professionals. This not only provides a benchmark for the adjuster’s assessment but also demonstrates due diligence on your part. Be prepared to discuss the rationale behind the estimates you present.

Know Your Policy: Familiarize yourself with the specifics of your insurance policy. Understand coverage limits, deductibles, and any exclusions that may apply. A clear grasp of these terms will empower you during negotiations and help you articulate your position effectively.

How Long Does an Insurance Adjustor Have to Respond?

The timeline for an insurance adjuster’s response to a claim varies considerably by state, with each jurisdiction establishing its own regulatory framework regarding the promptness of such communications. Generally, states may require insurance companies to acknowledge a claim within a specific time frame, often ranging from 10 to 30 days. This acknowledgment typically involves confirming receipt of the claim and may also include initial inquiries for additional information.

Once the acknowledgment is made, the adjuster is usually required to conduct an investigation and make a determination about the claim within a reasonable period, which is often defined as 30 to 60 days. However, complexities in the claim, such as the need for additional documentation or further investigation, may extend this timeline. States like California have specific laws mandating adjusters to respond promptly, while others may allow more flexibility.

It is important for policyholders to understand these timelines, as they can affect the overall claims process. If an adjuster fails to respond within the stipulated time, it could be grounds for a complaint with the state insurance department. Additionally, clear communication from the insured party can help facilitate a timely response, emphasizing the importance of thorough documentation and proactive engagement.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Additional FAQ

What Qualifications Are Needed to Become a Claims Adjuster?

To become a claims adjuster, candidates typically require a combination of education and relevant experience. A bachelor’s degree in fields such as finance, business, or insurance is beneficial. Additionally, obtaining state-specific licensure and certifications enhances employability.

Practical experience, often gained through internships or entry-level positions in insurance, is vital for developing necessary skills. Strong analytical abilities, attention to detail, and effective communication are also essential qualities that aspiring adjusters should cultivate.

Can Claims Adjusters Work Independently or Only for Insurance Companies?

In the domain of insurance, claims adjusters often resemble skilled navigators charting uncertain waters. While many choose to align with insurance companies, a significant number operate independently as freelancers or consultants.

This independence allows them to offer their expertise to multiple clients, enhancing flexibility and potentially increasing earning opportunities. Ultimately, the choice between working for an insurance company or independently depends on personal preferences, career goals, and the desire for autonomy in their profession.

How Do Claims Adjusters Handle Fraudulent Claims?

Claims adjusters employ a systematic approach to identify and address fraudulent claims. They meticulously investigate discrepancies by analyzing documentation, interviewing involved parties, and utilizing advanced technology to assess the legitimacy of claims.

Collaboration with law enforcement and industry databases further enhances their ability to detect fraud. By maintaining a keen attention to detail, adjusters uphold the integrity of the claims process, ensuring that resources are allocated appropriately and protecting the interests of the insurance industry.

What Software Tools Do Claims Adjusters Commonly Use?

Claims adjusters frequently utilize a variety of software tools to enhance their efficiency and accuracy in evaluating claims. Commonly employed applications include claims management systems, document management platforms, and estimating software.

These tools enable adjusters to streamline workflows, manage documentation, and create accurate cost estimates for repairs. Additionally, data analytics software aids in identifying patterns and trends, enhancing decision-making processes. Overall, the integration of technology greatly improves the claims assessment process.

Are There Any Continuing Education Requirements for Claims Adjusters?

Continuing education requirements for claims adjusters vary by state and employer. Many jurisdictions mandate regular training to maintain licensure, ensuring professionals stay updated on industry regulations, emerging technologies, and best practices.

Additionally, employers may encourage or require participation in workshops, seminars, or certification programs to enhance skills and knowledge. This commitment to ongoing education not only fosters professional growth but also reinforces the importance of maintaining high standards within the insurance industry.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Insurance Claim Types We Specialize In

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Select Your State:

Learn more about what our expert public adjusters can do for your residential insurance claims!

Learn about what our expert public adjusters can do for your commercial insurance claims!

Learn about what our public adjusting roofing specialists can do for you & your roofing claims!

Insurance adjusters work for THEM, our public adjusters work for YOU! Here’s how …