Work With Trusted & Experienced

New Hampshire Public Adjusters That Work For You!

100% Contingency Based. We Don't Get Paid Unless YOU Get Paid!

Don’t Settle For Less!

Get The HIGHEST & Most FAIR Settlement Amount ... That You Are Legally Entitled To ... From Your Insurance Claim!

Get a free on-site inspection & insurance policy evaluation from one of our expert public claims adjusters!

Work with highly trained, & certified New Hampshire public insurance claim adjusters who are licensed, bonded, and trained to handle all residential or commercial insurance claims, big or small!

Our New Hampshire public adjusters have technical and detailed expertise, which has satisfied countless homeowners, business owners, condominium management companies, and HOAs.

Our team of insurance claim experts have years of experience dealing with insurance companies. Many of our public adjusters in New Hampshire also have previous backgrounds in construction and/or insurance, giving us a significant advantage in quickly securing the highest claim settlement compensation for our clients.

We know what to look for, what repairs actually cost, and what the insurance company’s adjusters tend to ignore (and hope you don’t know about!).

Our inspections are free, and we are 100% contingency-based, meaning we only get paid if you do!

We take pride in maintaining superior customer service and providing clear and friendly communication. Contact us to speak with one of our expert New Hampshire insurance claim adjusters today!

Request A Free Estimate!

- Required Fields

*Service May Not Be Available In All Areas. EastBay Adjusters aim is to provide you with as much information as possible to allow you to make an informed decision when hiring a public adjuster in New Hampshire, & help connect you with the right public insurance claims adjuster in New Hampshire for your specific claim needs. Our team of experts, & decades of experience in the field, allow us to match you with the ideal New Hampshire public insurance adjuster for your specialized needs. When you hire a public claims adjuster in New Hampshire through EastBay Adjusters, you get a qualified, licensed professional, who can help maximize your insurance claim settlement compensation.

Why Hire A Public Insurance Claims Adjuster In New Hampshire?

We Get You The HIGHEST & Most Fair Settlement Amount (That You Are Legally Entitled To) From Your Homeowners Insurance, Roofing, & Business Insurance Claims!

Get a Free On-Site Inspection & Insurance Policy Evaluation From One Of Our Expert New Hampshire Public Claims Adjusters!

- We Save You Time & Help Speed Up The Claim Process!

- We Help Alleviate Stress & Walk You Through The Whole Process

- We Negotiate With The Insurance Company & Make Sure You Get The Highest Settlement Possible

- We Prepare & File All The Necessary Documents, And Handle All The Necessary Follow-up's

What Our Expert New Hampshire Public Insurance Adjusters Bring To The Table

New Hampshire Insurance Policy Claims Specialists

Our experts have years of experience in claims & reviewing coverages. As such, we understand the numerous types of policies and endorsements in New Hampshire. Our expertise allows us to find & utalize the various coverages your policy may have, and in many cases, inform you of coverage & clauses you may not even know about.

Advocates For New Hampshire Homeonwers Insurance Policy Holders

We advocate for your rights as the policy holder. We ensure that our clients’ rights are being protected throughout the claims process, and make sure you get all the benefits you are entitled to based on your policy. Our team of expert public claims adjusters in New Hampshire will be there with you every step of the way!

Experts In Seen & Unseen Damages

Our New Hampshire based public insurance claims adjusters have years of experience identifying damage, and in most cases, come from professional construction, roofing, and insurance backgrounds. As such, we are able to find & isolate damages that you may not even know to look for, or know would/should be covered by your policy! We also incorporate the latest assessment techniques & technology when conducting our property inspections.

Expert Negotiators

Settlement negotiation is critically important when it comes to the claims process in New Hampshire. We know how the insurance companies think, and come to the negotiation table fully prepared to make sure they know, that we know. Our expertise and experience in claims negotiations ensures that you get what you are actually entitled to under your policy ... not what the insurance company tells you that you are, based on their own interests. When the insurance company plays hardball or puts up a fight, we aren't afraid to get in that ring and fight them for what's rightfully yours!

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Learn more about what our expert public adjusters can do for your residential insurance claims!

Learn about what our expert public adjusters can do for your commercial insurance claims!

Learn about what our public adjusting roofing specialists can do for you & your roofing claims!

Insurance adjusters work for THEM, our public adjusters work for YOU! Here’s how …

Frequently Asked Questions (FAQ) About New Hampshire Public Adjusting

What Is A Public Adjuster In New Hampshire?

Imagine a New Hampshire public claims adjuster as the conductor of a symphony, orchestrating the numerous moving parts & players involved in securing your insurance claim benefits. Here at EastBay Adjusters, we specialize in steering through the complex world of insurance claims with expertise, & speed.

Just like a maestro leading a symphony, we skillfully guide your residential, commercial, or roofing insurance claim to a successful resolution!

- New Hampshire public claims adjusters are like skilled navigators, charting the course of your claim through turbulent waters, and helping policy holders avoid the pitfalls & roadblocks they don’t know to look out for.

- They are the guardian of your interests, ensuring that you receive fair and just compensation for your damages.

- Like a master craftsman, they meticulously piece together the puzzle of your claim, leaving no detail overlooked.

- A New Hampshire public claims adjuster is a beacon of light in the darkness of insurance complexities, guiding you towards a favorable outcome.

- They are the steadfast ally standing by your side, fighting tirelessly on your behalf to secure the highest settlement.

At EastBay Adjusters, we recognize the importance of feeling supported and protected during the claims process. Join our community of satisfied clients who have found a sense of protection, and peace of mind, in our expert care. Let us be your trusted partner & ally in the journey towards a fair and just resolution for your insurance claim.

What Do New Hampshire Public Adjusters Do?

At EastBay Adjusters, we serve as the bridge between you and your insurance company, ensuring that your claims process flows smoothly through an otherwise rocky & uncertain terrain.

- Like skilled navigators, we guide you through the intricate maze of insurance policies and procedures.

- Just as expert craftsmen, we meticulously assess damages to your property with precision and care.

- Similar to diligent detectives, we uncover every detail to maximize your insurance claim.

- Much like trusted advisors, we provide support and reassurance every step of the way.

- Like loyal companions, we stand by your side to fight for the compensation you deserve.

When you choose EastBay Adjusters, you’re not just a client – you’re a valued member of our community. Let us help you navigate the complex world of insurance claims with ease and expertise.

Will My Settlement Be Larger If I Hire A New Hampshire Public Adjusting Company?

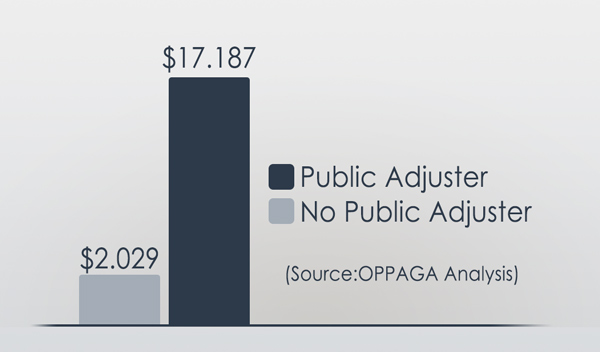

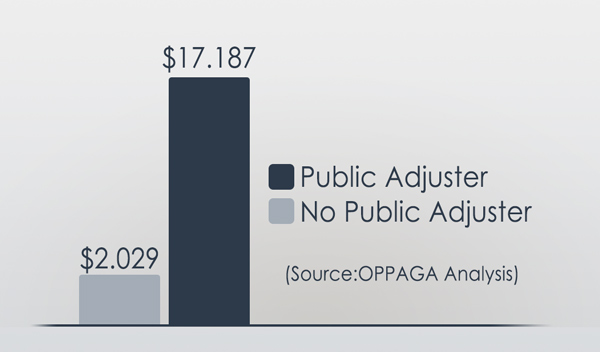

In most insurance claim cases in New Hampshire, yes, hiring a New Hampshire public adjusting firm can result in considerably larger settlement amounts, with recent studies showing an 800% higher settlement amount for policy holders who used a New Hampshire public adjuster.

At EastBay Adjusters, we recognize that maneuvering through insurance claims can feel like treading through a stormy sea. We are here to safely guide you through those choppy & confusing waters, and make sure you get what you are truly legally entitled to.

3 reasons why hiring a public adjusting company like EastBay Adjusters can lead to a larger settlement for your insurance claim:

- Expert Guidance: Our team of experienced public adjusters will navigate the complex waters of insurance claims on your behalf. We are experts when it comes to the ins-and-outs of the industry, and will guarantee that you receive the maximum settlement you deserve.

- Protecting Your Interests: We work tirelessly to make certain that your rights are upheld, and that you are not taken advantage of by the insurance company. Remember, the adjuster assigned to you by the insurance company is there to protect the insurance company’s interets, while a public adjuster is there to protect your interests.

- Maximizing Your Settlement: We will work diligently to maximize your settlement. Our expertise in evaluating damages, negotiating with insurance companies, and advocating for your rights will result in a larger settlement than if you were to navigate the claims process on your own.

So, if you’re wondering whether hiring a public adjusting company will lead to a larger settlement, the answer is a resounding yes nearly every time! Let EastBay Adjusters be the guiding light that leads you to a successful resolution of your insurance claim.

How Much Do New Hampshire Public Adjusters Charge?

Public adjuster fees varry by state, but typically range from 10%-20% of the total insurance settlement, depending on various factors such as the complexity of the claim and the adjuster’s experience. However, fees can go up to 30% for major or catostrophic claims that reqire months of work, and in most cases, an entire team of senior adjusters to be put on the case due to it’s complexity.

This fee structure is designed to align the interests of the adjuster and the policyholder, incentivizing public adjusters to maximize the settlement amount.

3 factors that influence the percentage charged by a public adjuster, include:

Claim Complexity: More complex claims, such as those involving extensive property damage or multiple types of losses, often warrant higher fees due to the extensive additional work, time, & team members required.

Experience and Reputation: Adjusters with a proven track record and significant experience may command higher fees, reflecting their expertise in guiding the claims process effectively.

Negotiation Skills: Skilled negotiators can secure higher settlements, justifying potentially higher fees based on the value they provide to the policyholder.

Understanding these fee structures is essential for policyholders considering hiring a public adjuster. It is important to weigh the potential benefits against the costs. For many, the expertise and advocacy provided by a public adjuster can lead to a substantially higher settlement, ultimately making the fee a worthwhile investment.

As you evaluate your options, consider not only the percentage but also the value of the services offered, ensuring you select a public adjuster who aligns with your needs and expectations.

How Are New Hampshire Public Insurance Claim Adjusters Paid?

At EastBay Adjusters, we recognize the importance of clarity when it comes to payment for our services. As public adjusters specializing in residential, commercial, and roofing insurance claims, we aim to provide transparent and fair compensation structures for our clients.

Here’s A Breakdown Of How Public Adjusters Are Typically Paid:

- Contingency Fee Agreement:

This is the most common payment method used by public adjusters. Under a contingency fee agreement, the adjuster’s fee is contingent upon successfully negotiating a higher settlement for the client.

The fee is usually a percentage of the final settlement amount, typically ranging from 5% to 20%. This guarantees that our interests are aligned with yours, as we only get paid if we secure a better outcome for you.

- Hourly Rate:

Some public adjusters may opt to charge an hourly rate for their services. This method involves billing the client for the actual time spent working on the claim, whether it’s conducting inspections, gathering documentation, or communicating with the insurance company. While this may offer more transparency regarding billing, it can also lead to uncertainty about the total cost of the services provided.

- Fixed Fee:

In some cases, public adjusters may offer a fixed fee for their services. This means that the client pays a set amount for the adjuster’s assistance, regardless of the final settlement amount. This can provide predictability concerning costs, but it may not always align the adjuster’s interests with the client’s, as there is no incentive to negotiate a higher settlement.

At EastBay Adjusters, we believe in the power of a contingency fee agreement to guarantee that our clients receive the best possible outcome. Our goal is to maximize your insurance claim settlement while providing exceptional service every step of the way. Contact us today to learn more about how we can assist you with your insurance claim needs.

When Should You Hire A Public Claims Adjuster In New Hampshire?

When faced with the overwhelming task of maneuvering through insurance claims for your residential, commercial, or roofing property, it’s vital to reflect on when to bring in a professional public adjuster. At EastBay Adjusters, we recognize the complexities of insurance policies and the importance of maximizing your claim settlement.

Here are three key signs that indicate it’s time to hire a public adjuster:

- Overwhelmed with Documentation: If you find yourself drowning in paperwork, receipts, and policy details, it may be time to seek assistance. A public adjuster can help organize and streamline the documentation process, making certain that nothing is overlooked or missed.

- Disputed Claim Amounts: When the insurance company offers a settlement that seems inadequate or undervalued, it’s important to have a public adjuster on your side. They can negotiate on your behalf to secure a fair and accurate claim amount that reflects the true extent of your damages.

- Complex Claims Process: Insurance claims can be intricate and time-consuming, especially when dealing with multiple parties or extensive damage. A public adjuster can simplify the process, acting as your advocate and guiding you through each step to guarantee a successful outcome.

Remember, at EastBay Adjusters, we’re here to support you through every stage of your insurance claim. Reach out to us when you’re ready to experience the peace of mind that comes with expert guidance and support.

How Long Does An Insurance Company Have To Investigate A Claim In New Hampshire?

In the state of New Hampshire, homeowners who have filed a claim with their insurance company often wonder how long the insurer has to investigate the claim before making a decision. According to New Hampshire state laws and regulations, insurance companies are required to conduct a thorough and timely investigation of a homeowner’s claim. Specifically, insurers have 30 days from the date of receipt of the claim to initiate an investigation and gather all necessary information. During this period, the insurer may request additional documentation or evidence to support the claim, and the policyholder is expected to cooperate fully. Once the investigation is complete, the insurer has 30 days to make a decision on the claim, either accepting it, denying it, or making an offer to settle. If the insurer needs more time to investigate, they must notify the policyholder in writing, explaining the reasons for the delay and providing an estimated timeframe for completion. Failure to comply with these timelines may be considered a breach of contract, and policyholders may have recourse through the New Hampshire Insurance Department or the courts. It’s essential for homeowners in New Hampshire to understand their rights and obligations under their insurance policy, as well as the state’s laws and regulations governing claims investigations, to ensure a smooth and successful claims process. By being informed and proactive, homeowners can navigate the often-complex process with confidence and secure a fair resolution to their claim.

What To Do If Insurance Company Is Stalling In New Hampshire?

If you’re a homeowner in New Hampshire, dealing with a stalling insurance company can be a frustrating and overwhelming experience, especially when you’re trying to recover from a property damage or loss. When an insurer drags their feet, it can lead to delayed repairs, additional living expenses, and emotional distress. If you find yourself in this situation, it’s essential to know your rights and options. First, review your policy to ensure you understand the process and timelines for claims resolution. Document all communication with your insurer, including dates, times, and details of conversations. Keep a record of your claim’s progress, and don’t hesitate to escalate the matter to a supervisor or the New Hampshire Insurance Department if necessary. However, if you’re not getting the response you need, consider seeking the expertise of a licensed public adjuster. A public adjuster can level the playing field by advocating on your behalf, ensuring your claim is handled fairly and efficiently. They will assess the damage, determine the scope of work, and negotiate with your insurer to secure a fair settlement. With a public adjuster’s guidance, you can focus on getting your life back to normal while they handle the complexities of the claims process. In New Hampshire, public adjusters are licensed professionals who work exclusively for policyholders, not insurance companies, so you can trust that their interests align with yours. By enlisting their help, you can overcome the stalling tactics of your insurance company and secure the compensation you deserve.

When Is It Too Late To Hire A New Hampshire Public Adjuster?

As the saying goes, ‘Better late than never’ – but when it comes to hiring a public adjuster, timing can be vital.

- Have you found yourself knee-deep in insurance claim paperwork after experiencing property damage?

- Are you feeling overwhelmed by the insurance claim process?

- Do you wish there was someone who could help you navigate through the complexities of filing a claim?

At EastBay Adjusters, we recognize the challenges that come with dealing with insurance claims for residential, commercial, or roofing damage. Our team of experienced public adjusters is here to help you every step of the way. Whether you’re just starting the claims process or feeling stuck in the middle, it’s never too late to reach out to us for assistance.

Imagine having someone by your side who knows the ins and outs of the insurance industry, someone who can advocate for you and guarantee that you receive the compensation you deserve. That’s where EastBay Adjusters comes in.

Don’t wait until it’s too late – contact us today and let us help you navigate the often confusing world of insurance claims. With EastBay Adjusters, you’ll never have to face the process alone.

Why should you hire a Public Insurance Claims Adjuster In New Hampshire if your insurance company has already assigned you an adjuster?

When your insurance company assigns you an adjuster, it’s crucial to understand that their adjuster’s loyalty lies with the insurance company. In contrast, our New Hampshire based licensed public adjusters are solely committed to representing you and your interests. This distinction is especially critical in cases of natural disasters like hurricanes.

Here’s why you should consider hiring a public adjuster in New Hampshire:

- Advocacy: Our public adjusters act as your advocates in insurance claims, making sure that your best interests are prioritized.

- Increased Settlements: Studies show that claims managed with the help of a public adjuster result in settlements that are 700% higher for hurricane-related claims and over 500% higher for non-catastrophe-related claims compared to those negotiated directly between the policyholder and the insurance company.

- Expertise: Having a skilled public adjuster on your side can greatly influence the outcome of your insurance claim, leading to more favorable settlements.

- Peace of Mind: With a dedicated professional handling your claim, you can have peace of mind knowing that your interests are being actively pursued throughout the process.

The effectiveness and significance of hiring a public adjuster are clear. Don’t settle for less when it comes to your insurance claims – choose EastBay Adjusters to guarantee you get the best possible outcome.

Can I File My Insurance Claim Myself?

Filing an insurance claim on your own can be done, but it’s essential to contemplate if it’s the best choice. Insurance policies are often complicated and filled with jargon that can be difficult to grasp. This complexity might lead to misunderstandings or errors that could harm your claim.

Our expert Public Adjusters can assist you. They are industry professionals with the expertise and experience to effectively handle insurance policies and claims. Each team member comprehends the nuances of insurance documents and can smoothly guide you through the entire claims process.

With their expertise, EastBay Adjusters can advocate for you, ensuring your claim is presented in the best light possible. They excel at identifying and articulating the details of your claim that might otherwise be overlooked.

Their professional support can greatly impact the outcome of your claim, potentially resulting in a more favorable settlement compared to handling it on your own.

Although you have the choice to file a claim independently, due to the complexity of insurance policies and the potential for better outcomes, it is highly recommended to seek the assistance of our skilled and experienced Public Adjusters. Their expertise can be an essential asset in maneuvering through the claims process and achieving the best possible result.

3 Reasons To Choose EastBay Adjusters:

- Expertise in residential, commercial, and roofing insurance claims.

- Professional assistance in maneuvering insurance policies effectively.

- Advocacy for a more favorable settlement outcome.

Can My Contractor Represent Me Against My Insurance Company?

As a policyholder, it is vital to understand why your contractor cannot represent you against your insurance company. Our team of licensed Public Adjusters in New Hampshire are the only professionals authorized to advocate for policyholders in the insurance claim process. This unique role allows them to work solely on your behalf, guiding you through the complexities of insurance claims with expertise and legal backing.

In New Hampshire, it is illegal for contractors to act as public adjusters. This rule is strictly enforced to uphold the integrity of the insurance claim process and safeguard policyholders from potential conflicts of interest or unethical behavior. If you come across a contractor posing as a public adjuster, it is your right and duty to report this violation to the New Hampshire Department of Insurance.

When reporting such misconduct, it is important to provide substantial evidence to support your claim. Solid proof is key to enabling the New Hampshire Department of Insurance to investigate and address the issue effectively, ensuring compliance with the laws governing the conduct of public adjusters and contractors. By taking action, you play a part in maintaining a fair and lawful insurance claim environment, protecting your interests and those of other policyholders in New Hampshire.

- Trust in our licensed Public Adjusters to represent you with expertise and legal authority.

- Uphold the integrity of the insurance claim process by reporting violations promptly.

- Provide concrete evidence to support your claim and enable effective investigation.

- Contribute to a fair and lawful insurance claim environment for all policyholders in New Hampshire.

I Already Settled My Claim, But It Wasn’t Enough Money To Cover The Damages. Is It Too Late To Try To Get More Money?

If you settled your claim but didn’t receive enough money to cover the damages, it’s not too late to try and get more. Our team of expert Public Adjusters can help, even if the damage occurred within the past five years. We offer a free review of your claim to see if you’re eligible for additional compensation.

During this evaluation, our skilled Public Adjusters will carefully examine every detail of your original claim. They will assess the damage, your coverage, and how the claim was handled previously. This review aims to identify any areas where you were under-compensated or where there were oversights leading to the denial of your claim.

If our review shows you deserve more money, we will take action. Our team will negotiate with your insurance company on your behalf, using our expertise to guarantee you get what you’re owed. We recognize insurance policies and the tactics used by insurance companies, empowering us to fight for your rights and secure a fair outcome.

Our goal is to reduce the stress of dealing with insurance claims, especially if you feel mistreated by your insurance provider. We provide professional guidance and support throughout the process, working to get you the compensation you deserve. Don’t lose hope if your claim was initially underpaid or denied; our expert Public Adjusters are here to fight for you.

Can My Insurance Company Cancel My Contract If I Use a Public Adjuster In New Hampshire?

No. Under existing laws and ethics that regulate the insurance industry, it is your LEGAL RIGHT to hire a certified public adjuster in New Hampshire. Canceling your contract for excercising your right, would be considered a violation & is illegal. An insurance company cannot terminate your policy if you hire a public adjuster.

What Is The Average Deductible For Roof Replacement In New Hampshire?

The average deductible for roof replacement in New Hampshire can vary significantly depending on several factors, including the type and age of the roof, location, and insurance provider. In general, homeowners in New Hampshire can expect to pay a deductible ranging from 1% to 5% of their total roof replacement cost. Based on the average cost of roof replacement in New Hampshire, which is around $8,000 to $12,000, the deductible would be between $80 and $600. However, it’s essential to note that some insurance policies may have a higher or lower deductible, and it’s crucial to review your policy carefully to understand your specific coverage. Additionally, some insurance providers may offer a higher deductible in exchange for a lower premium, while others may offer a lower deductible for a higher premium. Furthermore, the age of the roof and its condition can also impact the deductible, with older roofs or those in poor condition potentially resulting in a higher deductible. To get a more accurate estimate of the average deductible for roof replacement in New Hampshire, it’s recommended to consult with a licensed insurance professional or roofing contractor who can provide guidance based on your specific situation and location.

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

The Homeowners Insurance Claims Recovery Process In New Hampshire

Our licensed public adjusters are fluent in “Insurance Policy Jargon”, and will guide you through the entire property insurance claims process, while we fight to make sure you get the highest compensation possible for your claim!

Step #1

Make Sure Your Family Is Safe

When disaster strikes, the priority is to make sure your family is safe. Always have an emergency bag!

Step #2

Contact Our Public Adjusters In New Hampshire

Contact one of our expert certified public insurance adjusters to schedule an appointment for us to come out & meet with you to inspect the damage.

Step #3

Thorough Review Of Your Policy

One of our claims specialists will conduct a comprehensive review of your policy, note any coverage restrictions, coinsurance requirements, limitations, and review additional options that may be available to you.

Step #4

Create A Claims Strategy That Works For Your Specific Goals & Needs

We’ll discuss what is most important to you when it comes to your claim, then create & tailor the right claims strategy to take care of your family.

Step #5

We Take Care Of All Insurance Related Paperwork, Negotiations, & Follow Up.

Once we have agreed on a strategy, our specialists will:

- Meet with insurance company adjusters & personnel at the loss/damage location.

- Agree to the scope of damages & make sure that they are including all the damages in the scope, as well as clearly deciding on what should be repaired vs. replaced.

- Prepare a detailed reconstruction estimate.

- Prepare a detailed inventory of personal property.

Step #6

Negotiations & Final Settlement

Our expert claim negotiators will work to make sure you receive the highest settlement possible under your specific insurance policy.

Step #7

Restoration | Reconstruction | Relocation

We negotiate with the insurance company to ensure that you can achieve your specific goals. Whether that’s full or partial restoration, rebuilding your property, or a full-relocation.

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Discover How New Hampshire Public Claims Adjusters Can Get You More From These Types Of Homeowners Insurance Claims

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Find A Public Adjuster In New Hampshire Near You In One Of These Cities That We Service:

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Can You Be A Public Adjuster And An Independent Adjuster?

Public Adjuster Vs All Lines Adjuster

Private Adjuster Vs Public Adjuster

Public Adjuster Vs Attorney

Insurance Adjuster Vs. Attorney

Public Adjuster Vs Appraiser

Public Adjuster Vs Insurance Adjuster

Public Adjuster Vs Independent Adjuster

Appraiser Vs Adjuster

Inspector Vs Appraiser

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

More About New Hampshire

New Hampshire | |

|---|---|

State | |

Flag  Seal | |

| Nickname(s): Granite State White Mountain State | |

| Motto: “Live Free or Die” | |

| Anthem: “Old New Hampshire” | |

Map of the United States with New Hampshire highlighted | |

| Country | United States |

| Before statehood | Province of New Hampshire |

| Admitted to the Union | June 21, 1788 (9th) |

| Capital | Concord |

| Largest city | Manchester |

| Largest county or equivalent | Hillsborough |

| Largest metro and urban areas | Greater Boston (combined and metro) Nashua (urban) |

| Government | |

| • Governor | Chris Sununu (R) |

| • Senate President | Jeb Bradley (R) |

| Legislature | General Court |

| • Upper house | Senate |

| • Lower house | House of Representatives |

| Judiciary | New Hampshire Supreme Court |

| U.S. senators | Jeanne Shaheen (D) Maggie Hassan (D) |

| U.S. House delegation | 1: Chris Pappas (D) 2: Ann McLane Kuster (D) (list) |

| Area | |

| • Total | 9,350 sq mi (24,216 km) |

| • Land | 8,954 sq mi (23,190 km) |

| • Water | 396 sq mi (1,026 km) 4.2% |

| • Rank | 46th |

| Dimensions | |

| • Length | 190 mi (305 km) |

| • Width | 68 mi (110 km) |

| Elevation | 1,000 ft (300 m) |

| Highest elevation (Mount Washington) | 6,288 ft (1,916.66 m) |

| Lowest elevation (Atlantic Ocean) | 0 ft (0 m) |

| Population (2023) | |

| • Total | 1,402,054 |

| • Rank | 42nd |

| • Density | 150/sq mi (58/km) |

| • Rank | 21st |

| • Median household income | $89,992 |

| • Income rank | 7th |

| Demonym(s) | Granite Stater New Hampshirite |

| Language | |

| • Official language | English (French allowed for official business with Quebec; other languages allowed for certain specific uses) |

| Time zone | UTC−05:00 (Eastern) |

| • Summer (DST) | UTC−04:00 (EDT) |

| USPS abbreviation | NH |

| ISO 3166 code | US-NH |

| Traditional abbreviation | N.H. |

| Latitude | 42° 42′ N to 45° 18′ N |

| Longitude | 70° 36′ W to 72° 33′ W |

| Website | nh |

| List of state symbols | |

|---|---|

Flag of New Hampshire | |

Seal of New Hampshire | |

Emblem of New Hampshire | |

| Living insignia | |

| Amphibian | Red-spotted newt Notophthalmus viridescens |

| Bird | Purple finch Haemorhous purpureus |

| Butterfly | Karner Blue Lycaeides melissa samuelis |

| Dog breed | Chinook |

| Fish | Freshwater: Brook trout Salvelinus fontinalis Saltwater: Striped bass Morone saxatilis |

| Flower | Purple lilac Syringa vulgaris |

| Insect | Ladybug Coccinellidae |

| Mammal | White-tailed deer Odocoileus virginianus |

| Tree | White birch Betula papyrifera |

| Inanimate insignia | |

| Food | Fruit: Pumpkin Vegetable: White Potato Berry: Blackberry |

| Gemstone | Smoky quartz |

| Mineral | Beryl |

| Rock | Granite |

| Sport | Skiing |

| Tartan | New Hampshire state tartan |

| State route marker | |

| |

| State quarter | |

Released in 2000 | |

| Lists of United States state symbols | |

New Hampshire ( HAMP-shər) is a state in the New England region of the Northeastern United States. It borders Massachusetts to the south, Vermont to the west, Maine and the Gulf of Maine to the east, and the Canadian province of Quebec to the north. Of the 50 U.S. states, New Hampshire is the fifth smallest by area and the tenth least populous, with a population of 1,377,529 residents as of the 2020 census. Concord is the state capital and Manchester is the most populous city. New Hampshire’s motto, “Live Free or Die”, reflects its role in the American Revolutionary War; its nickname, “The Granite State”, refers to its extensive granite formations and quarries. It is well known nationwide for holding the first primary (after the Iowa caucus) in the U.S. presidential election cycle, and for its resulting influence on American electoral politics.

New Hampshire was inhabited for thousands of years by Algonquian-speaking peoples such as the Abenaki. Europeans arrived in the early 17th century, with the English establishing some of the earliest non-indigenous settlements. The Province of New Hampshire was established in 1629, named after the English county of Hampshire. Following mounting tensions between the British colonies and the crown during the 1760s, New Hampshire saw one of the earliest overt acts of rebellion, with the seizing of Fort William and Mary from the British in 1774. In January 1776, it became the first of the British North American colonies to establish an independent government and state constitution; six months later, it signed the United States Declaration of Independence and contributed troops, ships, and supplies in the war against Britain. In June 1788, it was the ninth state to ratify the U.S. Constitution, bringing that document into effect. Through the mid-19th century, New Hampshire was an active center of abolitionism, and fielded close to 32,000 Union soldiers during the U.S. Civil War. After the war, the state saw rapid industrialization and population growth, becoming a center of textile manufacturing, shoemaking, and papermaking; the Amoskeag Manufacturing Company in Manchester was at one time the largest cotton textile plant in the world. The Merrimack and Connecticut rivers were lined with industrial mills, most of which employed workers from Canada and Europe; French Canadians formed the most significant influx of immigrants, and today roughly a quarter of all New Hampshire residents have French American ancestry, second only to Maine.

Reflecting a nationwide trend, New Hampshire’s industrial sector declined after World War II. Since 1950, its economy diversified to include financial and professional services, real estate, education, transportation and high-tech, with manufacturing still higher than the national average. Beginning in the 1950s, its population surged as major highways connected it to Greater Boston and led to more commuter towns. New Hampshire is among the wealthiest and most-educated states. It is one of nine states without an income tax and has no taxes on sales, capital gains, or inheritance while relying heavily on local property taxes to fund education; consequently, its state tax burden is among the lowest in the country. It ranks among the top ten states in metrics such as governance, healthcare, socioeconomic opportunity, and fiscal stability. New Hampshire is one of the least religious states and known for its libertarian-leaning political culture; it was until recently a swing state in presidential elections.

SourcePublic Adjusters For Homeowners Insurance Claims

Public adjusters can simplify your homeowners insurance claims process, and maximize your compensation, ensuring higher settlement opportunities.

Service Type: Public Adjusting

Price: 10-20%

Currency: USD

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.