Roofing Adjusters

How Can Public Adjusters Help With Roof Damage Homeowners Insurance Claims?

100% Contingency Based. We Don't Get Paid Unless YOU Get Paid!

Roofing adjusters are invaluable when it comes to managing roof damage insurance claims for homeowners.

They simplify the claims process by evaluating damage, gathering essential documentation, and advocating for fair settlements with insurance companies.

Their expertise guarantees all damages are accounted for, which can lead to more favorable outcomes.

Additionally, roofing insurance claim public adjusters handle the intricate details of claim negotiations, relieving homeowners of considerable stress.

By providing support during a challenging time, they help secure timely repairs and compensation. Those interested in maximizing their claims can discover further insights on the benefits of hiring a public adjuster.

- Public adjusters conduct thorough damage assessments, documenting every detail to strengthen water damage claims for homeowners.

- We handle all necessary paperwork and negotiations, ensuring timely submission and minimizing delays in the claims process.

- Public adjusters are experts in interpreting insurance policies, identifying coverage areas often overlooked by homeowners.

- Our strategic negotiation techniques help secure fair settlements that accurately reflect the true extent of losses.

- Hiring a public adjuster significantly increases the chances of obtaining higher compensation, providing peace of mind during recovery.

Request a Free Estimate

- Required Fields

*Some Services May Not Be Available In All Areas

What Our Expert Roof Damage Claim Adjusters Bring To The Table

Policy & Claims Specialists

Our experts have years of experience in claims & reviewing coverages. As such, we understand the numerous types of policies and endorsements. Our expertise allows us to find & utalize the various coverages your policy may have, and in many cases, inform you of coverage & clauses you may not even know about.

Advocacy

We advocate for your rights as the policy holder. We ensure that our clients’ rights are being protected throughout the claims process, and make sure you get all the benefits you are entitled to based on your policy. Our team of expert adjusters will be there with you every step of the way!

Experts In Seen & Unseen Damages

Our claims adjusters have years of experience identifying damage, and in most cases, come from professional construction, roofing, and insurance backgrounds. As such, we are able to find & isolate damages that you may not even know to look for, or know would/should be covered by your policy! We also incorporate the latest assessment techniques & technology when conducting our property inspections.

Expert Negotiators

Settlement negotiation is critically important when it comes to the claims process. We know how the insurance companies think, and come to the negotiation table fully prepared to make sure they know, that we know. Our expertise and experience in claims negotiations ensures that you get what you are actually entitled to under your policy ... not what the insurance company tells you that you are, based on their own interests. When the insurance company plays hardball or puts up a fight, we aren't afraid to get in that ring and fight them for what's rightfully yours!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Table of Contents

Key Takeaways

- Roofing public adjusters advocate for homeowners, ensuring their interests are prioritized during the claims process for roof damage.

- They conduct thorough assessments, identifying all types of damage, including those often overlooked by insurers.

- Roofing adjusters prepare detailed loss documentation and negotiate with insurance companies for favorable settlements.

- Their expertise in insurance policies helps homeowners understand coverage details and maximize claim payouts.

- Hiring a roofing public claims adjuster alleviates stress, as they manage the entire claims process, saving homeowners time and effort.

Understanding Roof Damage Insurance Claims

Maneuvering the complexities of roof damage claims requires a clear understanding of the processes involved and the types of damage that can occur.

Homeowners often face challenges when seeking insurance coverage for roof repair, as various factors influence the outcome of a claim.

It is vital to recognize the common types of roof damage, including storm-related issues, wear and tear, and structural failures, as each type has different implications for insurance policies.

Understanding your specific insurance coverage is critical. Policies can vary considerably, with some covering only certain types of damage or requiring specific documentation to substantiate a claim. Homeowners should familiarize themselves with their policy details to guarantee they are adequately protected.

This includes knowing deductibles, policy limits, and any applicable exclusions.

When facing roof damage, documenting the extent of the damage through photographs and detailed notes can bolster your claim. Engaging with your insurance provider early in the process can also streamline communication and expedite the claim outcome.

Ultimately, a proactive approach to understanding roof damage claims empowers homeowners to navigate their insurance coverage effectively, guaranteeing they receive the support needed for timely roof repairs.

Role Of Expert Public Roofing Adjusters

Public adjusters’ role in roof damage claims is critical for homeowners seeking to maximize their insurance benefits.

These professionals serve as advocates for homeowners, ensuring that their interests are prioritized throughout the claims process.

Public adjuster responsibilities include thoroughly evaluating the damage, preparing detailed loss documentation, and negotiating with insurance companies on behalf of the homeowner.

By leveraging their expertise, public adjusters help homeowners navigate the complexities of insurance policies, which can often be overwhelming. They understand the nuances of the claims process, enabling them to identify all eligible damages that may be overlooked, ultimately leading to a more favorable settlement.

Homeowner advocacy is at the forefront of their mission; they work tirelessly to protect the rights of policyholders, working to secure the compensation necessary for proper repairs. In an environment where homeowners may feel vulnerable, public adjusters provide reassurance and support.

Their knowledge and commitment empower homeowners, transforming a intimidating experience into a manageable one. By engaging a public adjuster, homeowners can rest assured that they have a dedicated partner in their corner, working diligently to achieve a fair resolution for their roof damage claims.

Assessing Roof Damage Effectively

Effectively evaluating roof damage requires a systematic approach that includes visual inspection techniques, thorough documentation of damage evidence, and an all-encompassing understanding of relevant insurance policies.

Each of these elements plays a critical role in accurately gauging the extent of the damage and ensuring that claims are supported by compelling evidence.

By mastering these assessment strategies, homeowners can considerably improve their chances of a successful insurance claim.

Visual Inspection Techniques

Systematic visual inspection techniques are vital for accurately evaluating roof damage following a storm or other adverse events. A thorough evaluation guarantees that all potential issues are identified and builds a strong foundation for homeowners seeking to file insurance claims.

Among the most effective inspection methods are drone inspections. Drones provide a bird’ s-eye view of the roof, allowing for a detailed examination of hard-to-reach areas. Drones can quickly capture high-resolution images, revealing any signs of damage that may go unnoticed from the ground. This technology enhances safety by reducing the need for ladders and increases efficiency in evaluating large properties.

In addition to drone inspections, thermal imaging offers another layer of insight into roof conditions. By detecting temperature variations, thermal imaging can uncover hidden leaks or moisture issues that may not be visible during a standard inspection. This technology enables public adjusters to present a thorough evaluation, guaranteeing that homeowners receive the full insurance coverage benefits.

These visual inspection techniques empower homeowners by providing accurate evaluations that promote informed decision-making regarding necessary repairs and claims.

Documenting Evidence Of Roofing Damage

Accurate documentation of roof damage is essential for successfully maneuvering the claims process with insurance companies. Homeowners must meticulously gather and present evidence to substantiate their claims, ensuring they receive fair compensation for necessary repairs.

Photographic evidence plays a pivotal role in this documentation; clear, high-quality images can vividly illustrate the extent of damage sustained during a storm or other incidents. These visuals not only capture the condition of the roof but also provide context regarding the surrounding environment.

Additionally, maintenance records should be compiled and presented alongside photographic evidence. These records demonstrate the homeowner’s commitment to regular upkeep and can counter any potential claims of negligence by the insurance company. Homeowners reinforce their position by showcasing a history of maintenance, emphasizing that the damage was not due to poor care but rather external factors beyond their control.

Engaging a public adjuster can further enhance this process. These professionals are adept at compiling and presenting thorough documentation, ensuring all evidence is organized and compelling. By prioritizing accurate documentation, homeowners can significantly increase their chances of a successful claims outcome, fostering a sense of security and belonging in their community.

Understanding Roof Damage Insurance Policies

Managing the complexities of insurance policies is essential for homeowners seeking to assess roof damage effectively. Understanding the intricacies of your insurance policy can significantly impact your ability to obtain a fair settlement.

Homeowners must familiarize themselves with their policy details, including coverage limits and potential policy exclusions that could affect their claim.

Consider the following key aspects when reviewing your policy:

- Coverage Limits: Know how much your policy will pay for roof repairs or replacements.

- Policy Exclusions: Identify damages that are not covered, such as wear and tear or neglect.

- Deductibles: Understand the amount you must pay out-of-pocket before your insurance kicks in.

- Claim Process: Familiarize yourself with the steps to file a claim and any necessary documentation.

- Time Limits: Be aware of the timeframe to report damage and file a claim.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Documenting Losses For Roof Damage Homeowners Insurance Claims

Accurate documentation is essential for ensuring a successful roof damage claim, as it serves as the foundation for establishing the extent of the loss.

Various types of supporting evidence, including photographs, receipts, and repair estimates, can greatly strengthen your case.

Organizing this documentation efficiently not only streamlines the claims process but also enhances your credibility with insurers.

Importance Of Accurate Records

Maintaining thorough and precise records is essential when managing roof damage claims, as it directly influences the outcome of the insurance process. Effective record-keeping enhances claim accuracy and establishes credibility with your insurance provider. Documenting every aspect of the damage and your interactions with contractors sets a solid foundation for your claim.

To guarantee your records are exhaustive, consider including the following:

- Photographic Evidence: Capture clear images of the damage before any repairs.

- Repair Estimates: Keep all estimates from contractors to validate repair costs.

- Correspondence Records: Document all communications with your insurer and adjusters.

- Receipts and Invoices: Maintain receipts for any repairs or materials purchased.

- Timeline of Events: Create a chronological record of the damage occurrence and subsequent actions taken.

Types Of Supporting Evidence

While documenting losses for roof damage claims may seem intimidating, providing thorough supporting evidence is essential for a successful outcome. Homeowners must compile various types of documentation to substantiate their claims effectively.

One of the most crucial forms of supporting evidence is photographic evidence. Capturing clear images of the roof damage from multiple angles illustrates the extent of the loss and serves as a visual record that insurers can reference.

In addition to photographs, repair estimates play an essential role in the claims process. Obtaining detailed estimates from licensed contractors allows homeowners to present a clear picture of the necessary repairs and associated costs. These estimates should outline the scope of work required to restore the roof to its pre-damage condition, providing insurers with concrete figures to reflect on when evaluating the claim.

Together, photographic evidence and repair estimates create a compelling narrative that underscores the validity of the claim. By gathering and presenting these types of supporting evidence, homeowners can greatly improve their chances of receiving a fair settlement, fostering a sense of community and support among those facing similar challenges.

Organizing Documentation Efficiently

Organizing documentation efficiently is essential for homeowners seeking to navigate the complexities of roof damage claims. Properly documenting your losses not only supports your case but also helps you adhere to insurance company claim timelines. A well-structured approach can greatly enhance your chances of a successful claim.

To streamline this process, consider the following organizational strategies:

- Photographs: Capture detailed images of the roof damage, including close-ups and overall shots.

- Repair Estimates: Obtain multiple estimates from licensed contractors to provide a thorough view of repair costs.

- Correspondence: Keep records of all communications with your insurance company, including emails and phone call notes.

- Receipts: Maintain receipts for temporary repairs or related expenses incurred due to the damage.

- Policy Documents: Familiarize yourself with your insurance policy to understand coverage and exclusions.

Negotiating Roof Damage Claims With Homeowners Insurance Companies

Steering through the complexities of negotiating with insurance companies requires a strategic approach and a thorough understanding of policy details.

Homeowners facing roof damage can find this process intimidating, but effective claim strategies can greatly enhance the likelihood of a favorable outcome.

Engaging in negotiations without a solid grasp of your insurance policy can lead to missed opportunities and inadequate settlements.

Utilizing proven negotiation tactics is essential. For instance, being prepared with detailed documentation, including photographs of the damage and repair estimates, can strengthen your position. Clearly articulating the extent of the damage and its impact on your home’s value can help insurers understand the necessity of a fair payout.

Moreover, remaining assertive yet professional throughout the negotiation process fosters a collaborative atmosphere. Insurance companies are more likely to respond positively when approached with respect and clarity. Homeowners should also be aware of their rights and the obligations of the insurer, which can provide leverage in discussions.

With the right strategies and tactics, homeowners can navigate these negotiations more effectively, ensuring their claims are not only heard but adequately addressed.

Benefits Of Hiring An Expert Roofing Adjuster

Steering through the intricacies of roof damage claims can be overwhelming, but hiring a public adjuster can greatly streamline the process.

A public adjuster brings specialized knowledge and advocacy to your claim, ensuring it is handled with care and expertise.

The public adjuster advantages are numerous, enhancing claim process efficiency and helping you secure the compensation you deserve.

Engaging a public adjuster not only enhances the efficiency of your claims process but also fosters a sense of belonging to a community that values professionalism and support during recovery.

Here are some key benefits of hiring a public adjuster:

- Expertise in Insurance Policies: They understand the fine print and can interpret your policy effectively.

- Thorough Damage Assessment: Public adjusters provide detailed evaluations, ensuring no damage is overlooked.

- Time-Saving: They manage all communications and paperwork, freeing you to focus on your life.

- Negotiation Skills: With experience in negotiations, they advocate for your best interests and maximize your payout.

- Peace of Mind: Knowing a professional is handling your claim reduces stress during a challenging time.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

01.

Learn more about what our expert public adjusters can do for your residential insurance claims!

02.

Learn about what our expert public adjusters can do for your commercial insurance claims!

03.

Learn about what our public adjusting roofing specialists can do for you & your roofing claims!

04.

Insurance adjusters work for THEM, our public adjusters work for YOU! Here’s how …

The Roof Damage Homeowners Insurance Claim Recovery Process

Our licensed public adjusters are fluent in “Insurance Policy Jargon”, and will guide you through the entire property insurance claims process, while we fight to make sure you get the highest compensation possible for your claim!

Step #1

Make Sure Your Family Is Safe

When disaster strikes, the priority is to make sure your family is safe. Always have an emergency bag!

Step #2

Contact Our Public Adjusters

Contact one of our expert certified public insurance adjusters to schedule an appointment for us to come out & meet with you to inspect the damage.

Step #3

Thorough Review Of Your Policy

One of our claims specialists will conduct a comprehensive review of your policy, note any coverage restrictions, coinsurance requirements, limitations, and review additional options that may be available to you.

Step #4

Create A Claims Strategy That Works For Your Specific Goals & Needs

We’ll discuss what is most important to you when it comes to your claim, then create & tailor the right claims strategy to take care of your family.

Step #5

We Take Care Of All Insurance Related Paperwork, Negotiations, & Follow Up.

Once we have agreed on a strategy, our specialists will:

- Meet with insurance company adjusters & personnel at the loss/damage location.

- Agree to the scope of damages & make sure that they are including all the damages in the scope, as well as clearly deciding on what should be repaired vs. replaced.

- Prepare a detailed reconstruction estimate.

- Prepare a detailed inventory of personal property.

Step #6

Negotiations & Final Settlement

Our expert claim negotiators will work to make sure you receive the highest settlement possible under your specific insurance policy.

Step #7

Restoration | Reconstruction | Relocation

We negotiate with the insurance company to ensure that you can achieve your specific goals. Whether that’s full or partial restoration, rebuilding your property, or a full-relocation.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

FAQ

What Is A Public Claims Adjuster?

Imagine a public claims adjuster as the conductor of a symphony, orchestrating the harmonious blend of your insurance claim. Here at EastBay Adjusters, we specialize in steering through the complex world of insurance claims with finesse and expertise.

Just like a maestro leading a symphony, we skillfully guide your residential, commercial, or roofing insurance claim to a successful resolution.

- A public claims adjuster is like a skilled navigator, charting the course of your claim through turbulent waters.

- They are the guardian of your interests, ensuring that you receive fair and just compensation for your damages.

- Like a master craftsman, they meticulously piece together the puzzle of your claim, leaving no detail overlooked.

- A public claims adjuster is a beacon of light in the darkness of insurance complexities, guiding you towards a favorable outcome.

- They are the steadfast ally by your side, fighting tirelessly on your behalf to secure the best possible settlement.

At EastBay Adjusters, we recognize the importance of feeling supported and protected during the claims process. Join our community of satisfied clients who have found a sense of belonging and peace of mind in our expert care. Let us be your trusted partner in the journey towards a fair and just resolution for your insurance claim.

What Do Public Adjusters Do?

At EastBay Adjusters, we serve as the bridge between you and your insurance company, ensuring that your claims process flows smoothly like a river finding its way through a rocky terrain.

- Like skilled navigators, we guide you through the intricate maze of insurance policies and procedures.

- Just as expert craftsmen, we meticulously assess damages to your property with precision and care.

- Similar to diligent detectives, we uncover every detail to maximize your insurance claim.

- Much like trusted advisors, we provide support and reassurance every step of the way.

- Like loyal companions, we stand by your side to fight for the compensation you deserve.

When you choose EastBay Adjusters, you’re not just a client – you’re a valued member of our community. Let us help you navigate the complex world of insurance claims with ease and expertise.

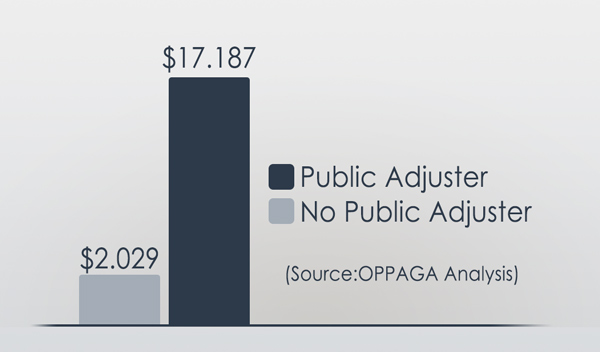

Will My Settlement Be Larger If I Hire a Public Adjusting Company?

In most cases, yes, hiring a public adjusting firm can result in considerably larger settlement amounts, with recent studies showing a 800% higher settlement amount for policy holders who used a public adjuster.

At EastBay Adjusters, we recognize that maneuvering through insurance claims can feel like treading through a stormy sea. We are here to safely guide you through those choppy & confusing waters, and make sure you get what you are truly legally entitled to.

3 reasons why hiring a public adjusting company like EastBay Adjusters can lead to a larger settlement for your insurance claim:

- Expert Guidance: Our team of experienced public adjusters will navigate the complex waters of insurance claims on your behalf. We are experts when it comes to the ins-and-outs of the industry, and will guarantee that you receive the maximum settlement you deserve.

- Protecting Your Interests: We work tirelessly to make certain that your rights are upheld, and that you are not taken advantage of by the insurance company. Remember, the adjuster assigned to you by the insurance company is there to protect the insurance company’s interets, while a public adjuster is there to protect your interests.

- Maximizing Your Settlement: We will work diligently to maximize your settlement. Our expertise in evaluating damages, negotiating with insurance companies, and advocating for your rights will result in a larger settlement than if you were to navigate the claims process on your own.

So, if you’re wondering whether hiring a public adjusting company will lead to a larger settlement, the answer is a resounding yes nearly every time! Let EastBay Adjusters be the guiding light that leads you to a successful resolution of your insurance claim.

How Much Do Public Adjusters Charge?

Public adjuster fees varry by state, but typically range from 10%-20% of the total insurance settlement, depending on various factors such as the complexity of the claim and the adjuster’s experience. However, fees can go up to 30% for major or catostrophic claims that reqire months of work, and in most cases, an entire team of senior adjusters to be put on the case due to it’s complexity.

This fee structure is designed to align the interests of the adjuster and the policyholder, incentivizing public adjusters to maximize the settlement amount.

3 factors that influence the percentage charged by a public adjuster, include:

Claim Complexity: More complex claims, such as those involving extensive property damage or multiple types of losses, often warrant higher fees due to the extensive additional work, time, & team members required.

Experience and Reputation: Adjusters with a proven track record and significant experience may command higher fees, reflecting their expertise in guiding the claims process effectively.

Negotiation Skills: Skilled negotiators can secure higher settlements, justifying potentially higher fees based on the value they provide to the policyholder.

Understanding these fee structures is essential for policyholders considering hiring a public adjuster. It is important to weigh the potential benefits against the costs. For many, the expertise and advocacy provided by a public adjuster can lead to a substantially higher settlement, ultimately making the fee a worthwhile investment.

As you evaluate your options, consider not only the percentage but also the value of the services offered, ensuring you select a public adjuster who aligns with your needs and expectations.

How Are Public Adjusters Paid?

At EastBay Adjusters, we recognize the importance of clarity when it comes to payment for our services. As public adjusters specializing in residential, commercial, and roofing insurance claims, we aim to provide transparent and fair compensation structures for our clients.

Here’s A Breakdown Of How Public Adjusters Are Typically Paid:

- Contingency Fee Agreement:

This is the most common payment method used by public adjusters. Under a contingency fee agreement, the adjuster’s fee is contingent upon successfully negotiating a higher settlement for the client.

The fee is usually a percentage of the final settlement amount, typically ranging from 5% to 20%. This guarantees that our interests are aligned with yours, as we only get paid if we secure a better outcome for you.

- Hourly Rate:

Some public adjusters may opt to charge an hourly rate for their services. This method involves billing the client for the actual time spent working on the claim, whether it’s conducting inspections, gathering documentation, or communicating with the insurance company. While this may offer more transparency regarding billing, it can also lead to uncertainty about the total cost of the services provided.

- Fixed Fee:

In some cases, public adjusters may offer a fixed fee for their services. This means that the client pays a set amount for the adjuster’s assistance, regardless of the final settlement amount. This can provide predictability concerning costs, but it may not always align the adjuster’s interests with the client’s, as there is no incentive to negotiate a higher settlement.

At EastBay Adjusters, we believe in the power of a contingency fee agreement to guarantee that our clients receive the best possible outcome. Our goal is to maximize your insurance claim settlement while providing exceptional service every step of the way. Contact us today to learn more about how we can assist you with your insurance claim needs.

When Should You Hire A Public Adjuster?

When faced with the overwhelming task of maneuvering through insurance claims for your residential, commercial, or roofing property, it’s vital to reflect on when to bring in a professional public adjuster. At EastBay Adjusters, we recognize the complexities of insurance policies and the importance of maximizing your claim settlement.

Here are three key signs that indicate it’s time to hire a public adjuster:

- Overwhelmed with Documentation: If you find yourself drowning in paperwork, receipts, and policy details, it may be time to seek assistance. A public adjuster can help organize and streamline the documentation process, making certain that nothing is overlooked or missed.

- Disputed Claim Amounts: When the insurance company offers a settlement that seems inadequate or undervalued, it’s important to have a public adjuster on your side. They can negotiate on your behalf to secure a fair and accurate claim amount that reflects the true extent of your damages.

- Complex Claims Process: Insurance claims can be intricate and time-consuming, especially when dealing with multiple parties or extensive damage. A public adjuster can simplify the process, acting as your advocate and guiding you through each step to guarantee a successful outcome.

Remember, at EastBay Adjusters, we’re here to support you through every stage of your insurance claim. Reach out to us when you’re ready to experience the peace of mind that comes with expert guidance and support.

Can I Hire a Public Adjuster After Filing My Claim?

Yes, you can hire a public adjuster after claim filing. They’ll assist you in guiding insurance negotiations, ensuring you receive a fair settlement. Their expertise can greatly impact the outcome of your claim.

When Is It Too Late To Hire a Public Adjuster?

As the saying goes, ‘Better late than never’ – but when it comes to hiring a public adjuster, timing can be vital.

- Have you found yourself knee-deep in insurance claim paperwork after experiencing property damage?

- Are you feeling overwhelmed by the insurance claim process?

- Do you wish there was someone who could help you navigate through the complexities of filing a claim?

At EastBay Adjusters, we recognize the challenges that come with dealing with insurance claims for residential, commercial, or roofing damage. Our team of experienced public adjusters is here to help you every step of the way. Whether you’re just starting the claims process or feeling stuck in the middle, it’s never too late to reach out to us for assistance.

Imagine having someone by your side who knows the ins and outs of the insurance industry, someone who can advocate for you and guarantee that you receive the compensation you deserve. That’s where EastBay Adjusters comes in.

Don’t wait until it’s too late – contact us today and let us help you navigate the often confusing world of insurance claims. With EastBay Adjusters, you’ll never have to face the process alone.

How Long Does the Claims Process Usually Take With a Public Adjuster?

When you’re in the thick of it, the claims timeline can feel endless. With an adjuster’s involvement, you’ll navigate the process smoother, often reducing wait times and ensuring you get what you deserve faster.

Why should you hire a Public Adjuster if your insurance company has already assigned you an adjuster?

When your insurance company assigns you an adjuster, it’s crucial to understand that their loyalty lies with the company. In contrast, our licensed public adjusters are solely committed to representing you and your interests. This distinction is especially critical in cases of natural disasters like hurricanes.

Here’s why you should consider hiring a public adjuster:

- Advocacy: Our public adjusters act as your advocates in insurance claims, making sure that your best interests are prioritized.

- Increased Settlements: Studies show that claims managed with the help of a public adjuster result in settlements that are 700% higher for hurricane-related claims and over 500% higher for non-catastrophe-related claims compared to those negotiated directly between the policyholder and the insurance company.

- Expertise: Having a skilled public adjuster on your side can greatly influence the outcome of your insurance claim, leading to more favorable settlements.

- Peace of Mind: With a dedicated professional handling your claim, you can have peace of mind knowing that your interests are being actively pursued throughout the process.

The effectiveness and significance of hiring a public adjuster are clear. Don’t settle for less when it comes to your insurance claims – choose EastBay Adjusters to guarantee you get the best possible outcome.

Can I File My Insurance Claim Myself?

Filing an insurance claim on your own can be done, but it’s essential to contemplate if it’s the best choice. Insurance policies are often complicated and filled with jargon that can be difficult to grasp. This complexity might lead to misunderstandings or errors that could harm your claim.

Our expert Public Adjusters can assist you. They are industry professionals with the expertise and experience to effectively handle insurance policies and claims. Each team member comprehends the nuances of insurance documents and can smoothly guide you through the entire claims process.

With their expertise, EastBay Adjusters can advocate for you, ensuring your claim is presented in the best light possible. They excel at identifying and articulating the details of your claim that might otherwise be overlooked.

Their professional support can greatly impact the outcome of your claim, potentially resulting in a more favorable settlement compared to handling it on your own.

Although you have the choice to file a claim independently, due to the complexity of insurance policies and the potential for better outcomes, it is highly recommended to seek the assistance of our skilled and experienced Public Adjusters. Their expertise can be an essential asset in maneuvering through the claims process and achieving the best possible result.

3 Reasons To Choose EastBay Adjusters:

- Expertise in residential, commercial, and roofing insurance claims.

- Professional assistance in maneuvering insurance policies effectively.

- Advocacy for a more favorable settlement outcome.

Can My Contractor Represent Me Against My Insurance Company?

As a policyholder, it is vital to understand why your contractor cannot represent you against your insurance company. Our team of licensed Public Adjusters are the only professionals authorized to advocate for policyholders in the insurance claim process. This unique role allows them to work solely on your behalf, guiding you through the complexities of insurance claims with expertise and legal backing.

In Texas, it is illegal for contractors to act as public adjusters. This rule is strictly enforced to uphold the integrity of the insurance claim process and safeguard policyholders from potential conflicts of interest or unethical behavior. If you come across a contractor posing as a public adjuster, it is your right and duty to report this violation to the Texas Department of Insurance.

When reporting such misconduct, it is important to provide substantial evidence to support your claim. Solid proof is key to enabling the Texas Department of Insurance to investigate and address the issue effectively, ensuring compliance with the laws governing the conduct of public adjusters and contractors. By taking action, you play a part in maintaining a fair and lawful insurance claim environment, protecting your interests and those of other policyholders in Texas.

- Trust in our licensed Public Adjusters to represent you with expertise and legal authority.

- Uphold the integrity of the insurance claim process by reporting violations promptly.

- Provide concrete evidence to support your claim and enable effective investigation.

- Contribute to a fair and lawful insurance claim environment for all policyholders in Texas.

I Already Settled My Claim, But It Wasn’t Enough Money To Cover The Damages. Is It Too Late To Try To Get More Money?

If you settled your claim but didn’t receive enough money to cover the damages, it’s not too late to try and get more. Our team of expert Public Adjusters can help, even if the damage occurred within the past five years. We offer a free review of your claim to see if you’re eligible for additional compensation.

During this evaluation, our skilled Public Adjusters will carefully examine every detail of your original claim. They will assess the damage, your coverage, and how the claim was handled previously. This review aims to identify any areas where you were under-compensated or where there were oversights leading to the denial of your claim.

If our review shows you deserve more money, we will take action. Our team will negotiate with your insurance company on your behalf, using our expertise to guarantee you get what you’re owed. We recognize insurance policies and the tactics used by insurance companies, empowering us to fight for your rights and secure a fair outcome.

Our goal is to reduce the stress of dealing with insurance claims, especially if you feel mistreated by your insurance provider. We provide professional guidance and support throughout the process, working to get you the compensation you deserve. Don’t lose hope if your claim was initially underpaid or denied; our expert Public Adjusters are here to fight for you.

Can My Insurance Company Cancel My Contract If I Use a Public Adjuster?

No. Under existing laws and ethics that regulate the insurance industry, it is your LEGAL RIGHT to hire a certified public adjuster. Canceling your contract for excercising your right, would be considered a violation & is illegal. An insurance company cannot terminate your policy if you hire a public adjuster.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Get The HIGHEST & Most FAIR Settlement Amount Possible From Your Roof Damage Homeowners Insurance Claim!

Get a free on-site inspection & insurance policy evaluation from one of our expert public claims adjusters!

Work with public insurance claim adjusters who are licensed, bonded, and trained to handle all residential or commercial insurance claims, big or small! Our public insurance adjusters’ technical and detailed expertise has satisfied countless homeowners, business owners, condominium management companies, and HOAs.

Our team of experts have years of experience dealing with insurance companies. Many of our public adjusters also have previous backgrounds in construction, giving us a significant advantage in quickly securing the most compensation for our clients. We know what to look for, what repairs actually cost, and what the insurance company’s adjusters tend to ignore (and hope you don’t know about!).

Our inspections are free, and we are 100% contingency-based, meaning we only get paid if you do!

We take pride in maintaining superior customer service and providing clear and friendly communication. Contact us to speak with one of our expert adjusters today!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

10 Tips For Filing Roof Damage Homeowners Insurance Claims

Roofing Adjusters For Roof Damage Homeowners Insurance Claims

Learn how roofing adjusters can simplify your roof damage homeowners insurance claims process, and maximize your compensation, ensuring higher settlement opportunities.

Service Type: Roofing Adjusters For Roof Damage Homeowners Insurance Claims

Price: 10-20%

Currency: USD

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.