Storm & Wind Damage Public Adjusters

How Can Public Adjusters Help With Storm & Wind Damage Homeowners Insurance Claims?

100% Contingency Based. We Don't Get Paid Unless YOU Get Paid!

Storm & wind damage public adjusters greatly aid homeowners in maneuvering storm and wind damage claims. Their expertise guarantees thorough documentation of damages, including both visible and hidden issues often overlooked by insurers.

They possess a deep understanding of policy intricacies, enhancing the likelihood of maximized settlements. By skillfully negotiating with insurance companies, public adjusters advocate for the best interests of homeowners, often resulting in compensation that exceeds the costs of their services.

This professional guidance alleviates the stress of managing complex claims processes. Discover more about how employing a public adjuster can streamline your insurance experience and improve your compensation outcome.

- Public adjusters conduct thorough damage assessments, documenting every detail to strengthen water damage claims for homeowners.

- We handle all necessary paperwork and negotiations, ensuring timely submission and minimizing delays in the claims process.

- Public adjusters are experts in interpreting insurance policies, identifying coverage areas often overlooked by homeowners.

- Our strategic negotiation techniques help secure fair settlements that accurately reflect the true extent of losses.

- Hiring a public adjuster significantly increases the chances of obtaining higher compensation, providing peace of mind during recovery.

Request a Free Estimate

- Required Fields

*Some Services May Not Be Available In All Areas

What Our Expert Storm & Wind Damage Public Adjusters Bring To The Table

Policy & Claims Specialists

Our experts have years of experience in claims & reviewing coverages. As such, we understand the numerous types of policies and endorsements. Our expertise allows us to find & utalize the various coverages your policy may have, and in many cases, inform you of coverage & clauses you may not even know about.

Advocacy

We advocate for your rights as the policy holder. We ensure that our clients’ rights are being protected throughout the claims process, and make sure you get all the benefits you are entitled to based on your policy. Our team of expert adjusters will be there with you every step of the way!

Experts In Seen & Unseen Damages

Our claims adjusters have years of experience identifying damage, and in most cases, come from professional construction, roofing, and insurance backgrounds. As such, we are able to find & isolate damages that you may not even know to look for, or know would/should be covered by your policy! We also incorporate the latest assessment techniques & technology when conducting our property inspections.

Expert Negotiators

Settlement negotiation is critically important when it comes to the claims process. We know how the insurance companies think, and come to the negotiation table fully prepared to make sure they know, that we know. Our expertise and experience in claims negotiations ensures that you get what you are actually entitled to under your policy ... not what the insurance company tells you that you are, based on their own interests. When the insurance company plays hardball or puts up a fight, we aren't afraid to get in that ring and fight them for what's rightfully yours!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Table of Contents

Key Takeaways

- Public adjusters evaluate and document storm and wind damage, ensuring comprehensive evidence to support homeowners’ claims.

- They possess in-depth knowledge of insurance policies, helping homeowners navigate complex terms and coverage limits.

- Skilled negotiators, public adjusters aim to maximize settlements, often covering their fees through increased compensation.

- They identify both visible and hidden damages, providing unbiased assessments that strengthen the claims process.

- Public adjusters manage communication with insurance companies, reducing stress and facilitating smoother negotiations for homeowners.

Understanding Storm & Wind Damage Public Adjusters

Steering through the complexities of homeowners insurance claims can be intimidating for many policyholders, often leaving them vulnerable to coverage inadequacies.

Public adjusters play a crucial role in guiding this intricate insurance claim process. These licensed professionals advocate for homeowners, ensuring that they receive fair and just compensation for their losses.

The primary responsibilities of public adjusters include evaluating property damage, documenting losses, and negotiating with insurance companies on behalf of the policyholder. Their expertise in the insurance claim process is indispensable, as they possess a deep understanding of policy language and coverage limits. By employing a public adjuster, homeowners can level the playing field against insurance companies, which often employ their own adjusters to minimize payouts.

Moreover, public adjusters not only streamline the claims process but also provide peace of mind to policyholders who may feel overwhelmed by the intricacies of insurance claims. Their primary goal is to safeguard the interests of homeowners, ensuring they receive adequate compensation for their claims. Ultimately, understanding the essential roles that public adjusters play can empower policyholders to make informed decisions about their insurance claims and foster a sense of security in their coverage.

The Storm & Wind Damage Insurance Claims Process Simplified

Steering through the homeowners insurance claims process can often feel overwhelming for many policyholders, yet understanding its fundamental steps is important for maximizing compensation.

The claims process typically begins with notifying your insurance company about the storm or wind damage, which initiates your claim timeline. Prompt reporting is essential, as delays can hinder your claim’s progress.

Once your claim is filed, the next step involves thorough claim documentation. Policyholders should meticulously gather evidence, including photographs of the damage, repair estimates, and any relevant receipts. This documentation will serve as the backbone of your claim and can greatly influence the outcome.

Following submission, an adjuster will assess the damage, aligning their findings with your documentation. This stage is critical; therefore, engaging in open communication with your insurance representative is important to addressing any questions or discrepancies.

Benefits Of Hiring A Public Adjuster For Storm & Wind Damage

When managing the complexities of homeowners insurance claims, hiring a public adjuster can provide notable advantages for policyholders.

These professionals possess the expertise to navigate intricate claims processes, ensuring that homeowners receive an equitable settlement.

Here are three compelling benefits of engaging a public adjuster:

- Expert Guidance: Public adjusters are well-versed in insurance policies and regulations, offering insights that can greatly enhance the clarity of the claims process. Their expertise can help policyholders avoid costly mistakes.

- Maximized Settlements: With their extensive knowledge and negotiation skills, public adjusters work diligently to secure the highest possible settlement for clients. Numerous client testimonials highlight the success stories of policyholders who received far more than they initially anticipated.

- Cost Considerations: While some may view hiring a public adjuster as an additional expense, the reality is that the benefits often outweigh the costs. The potential increase in settlement amounts frequently covers their fees, making it a financially sound decision.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Assessing Storm and Wind Damage Before Filing A Homeowners Insurance Claim

The aftermath of a storm can leave homeowners grappling with the intimidating task of evaluating wind damage and its impact on their property.

A thorough damage assessment is essential, as it not only determines the extent of repairs needed but also influences the outcome of insurance claims.

Homeowners must meticulously examine both visible and hidden damages, including roof leaks, broken windows, and compromised structural integrity.

The storm impact can vary greatly, making it imperative to document every detail. Taking photographs and notes can help create a detailed record that may prove invaluable during the insurance claims process.

Engaging a public adjuster can further enhance this assessment, as these professionals possess the expertise to identify damages that homeowners may overlook. They can provide an unbiased perspective, ensuring that all storm-related damages are accounted for accurately.

Ultimately, a thorough damage assessment not only fosters peace of mind but also empowers homeowners in their journey to restore their properties. By embracing a proactive approach and seeking professional guidance, homeowners can navigate the complexities of storm damage with confidence, fostering a sense of belonging within their community.

Negotiating With Insurance Companies

Negotiating with insurance companies requires a thorough understanding of your policy coverage to guarantee that all eligible claims are appropriately addressed.

Effective communication strategies are essential in articulating your needs and expectations while fostering a collaborative relationship with the insurer.

By strategically presenting your case, you can enhance the likelihood of achieving a favorable settlement.

Understanding Policy Coverage

Understanding the nuances of policy coverage is essential for homeowners seeking to navigate the complexities of insurance claims effectively. A thorough comprehension of coverage limits and policy exclusions can greatly enhance the likelihood of receiving a fair settlement. Homeowners often face challenges when dealing with insurance companies, and knowing the specifics of their policy can empower them in negotiations.

To facilitate this understanding, consider these key points:

- Policy Exclusions: Familiarize yourself with what is not covered under your policy. This knowledge is crucial, as certain perils may be explicitly excluded, which could impact your claim.

- Coverage Limits: Understand the maximum amount your policy will pay for specific types of damage. Being aware of these limits helps in setting realistic expectations during the claims process.

- Additional Living Expenses: Know whether your policy covers temporary housing costs if your home is uninhabitable due to storm damage. This can alleviate financial strain during repairs.

Effective Communication Strategies

Effective communication stands as a crucial element in the negotiation process with insurance companies, where clarity and assertiveness can greatly influence the outcome of a claim. To navigate this complex landscape, employing strategies such as active listening and clear messaging is essential.

Active listening allows homeowners to fully understand the nuances of the insurance adjuster’s perspective, fostering a respectful dialogue that encourages collaboration. By acknowledging the adjuster’s points, homeowners demonstrate engagement and openness, which can facilitate better negotiation outcomes.

Simultaneously, clear messaging is essential when articulating the specifics of the claim. Homeowners should prepare concise summaries of their damages and articulate the rationale for their claims with precision. This clarity not only showcases the legitimacy of the claim but also helps prevent misunderstandings that could delay the process.

Ultimately, effective communication serves as the bridge between homeowners and insurance companies. By mastering these strategies, homeowners can advocate for their interests more effectively, fostering a sense of belonging within the claims process. This approach not only enhances the likelihood of a favorable outcome but also builds a foundation of trust and cooperation with insurance professionals.

Maximizing Your Storm & Wind Damage Insurance Payout

To maximize your insurance payout, it is essential to fully understand your policy coverage, as this knowledge directly influences the claims process.

Effectively documenting damage with thorough evidence further strengthens your position during negotiations with insurers.

By strategically leveraging these elements, homeowners can greatly enhance their chances of receiving a fair and adequate compensation for their losses.

Understanding Policy Coverage

Maneuvering the complexities of homeowners insurance policies is crucial for maximizing your insurance payout following a loss. Policy coverage’s nuances can greatly impact your financial recovery after storm or wind damage. Homeowners often overlook critical aspects that dictate how and when they can file claims.

Key considerations include:

- Policy Exclusions: Familiarize yourself with what is not covered. Some policies may exclude specific types of storm damage, such as flooding or wear and tear, which could leave homeowners vulnerable.

- Coverage Limits: Each policy has defined limits on various types of damage. Knowing these limits can help you strategize your claims and avoid unpleasant surprises during the settlement process.

- Endorsements and Riders: These additions can enhance your coverage. Understanding available endorsements can help guarantee that essential protections are in place, allowing for a more thorough approach to your claim.

Documenting Damage Effectively

Documenting damage meticulously is essential for ensuring a favorable outcome in your homeowners insurance claim. A thorough damage assessment allows homeowners to present a compelling case to insurers, thereby maximizing their potential payout. Effective documentation techniques are key in this process, as they provide clear evidence of the extent and impact of the damage incurred.

Begin by taking high-quality photographs of all affected areas, capturing both wide shots and close-ups of specific damages. Be sure to record the date and time of the incident and make notes on the conditions that contributed to the damage. This detailed narrative can serve as a valuable reference during your claim process.

Additionally, organize relevant receipts, repair estimates, and contractor assessments to further substantiate your claim. These documents will reinforce your position and demonstrate the financial implications of the damage. Engaging a public adjuster can also enhance your documentation efforts, as they possess expertise in conducting thorough damage assessments and ensuring that no detail is overlooked. By focusing on meticulous documentation, you empower yourself to navigate the complexities of insurance claims and secure the compensation you rightfully deserve.

Negotiating With Insurers

Negotiating with insurers requires a strategic approach that emphasizes clear communication and a well-supported claim. Homeowners often face claim disputes that can greatly affect their settlement outcomes.

To maximize your insurance payout, consider the following settlement strategies:

- Comprehensive Documentation: Confirm that all damage is thoroughly documented, including photographs, repair estimates, and expert opinions. This evidence will strengthen your position during negotiations.

- Understand Policy Terms: Familiarize yourself with your insurance policy’s specific terms and coverage limits. A clear understanding will empower you to articulate your claim effectively and challenge any unjust denials or low offers.

- Engage a Public Adjuster: Partnering with a public adjuster can be invaluable. They are experienced negotiators who understand the intricacies of insurance claims and can advocate on your behalf, making sure your interests are prioritized.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

01.

Learn more about what our expert public adjusters can do for your residential insurance claims!

02.

Learn about what our expert public adjusters can do for your commercial insurance claims!

03.

Learn about what our public adjusting roofing specialists can do for you & your roofing claims!

04.

Insurance adjusters work for THEM, our public adjusters work for YOU! Here’s how …

The Storm & Wind Damage Homeowners Insurance Claim Recovery Process

Our licensed public adjusters are fluent in “Insurance Policy Jargon”, and will guide you through the entire property insurance claims process, while we fight to make sure you get the highest compensation possible for your claim!

Step #1

Make Sure Your Family Is Safe

When disaster strikes, the priority is to make sure your family is safe. Always have an emergency bag!

Step #2

Contact Our Public Adjusters

Contact one of our expert certified public insurance adjusters to schedule an appointment for us to come out & meet with you to inspect the damage.

Step #3

Thorough Review Of Your Policy

One of our claims specialists will conduct a comprehensive review of your policy, note any coverage restrictions, coinsurance requirements, limitations, and review additional options that may be available to you.

Step #4

Create A Claims Strategy That Works For Your Specific Goals & Needs

We’ll discuss what is most important to you when it comes to your claim, then create & tailor the right claims strategy to take care of your family.

Step #5

We Take Care Of All Insurance Related Paperwork, Negotiations, & Follow Up.

Once we have agreed on a strategy, our specialists will:

- Meet with insurance company adjusters & personnel at the loss/damage location.

- Agree to the scope of damages & make sure that they are including all the damages in the scope, as well as clearly deciding on what should be repaired vs. replaced.

- Prepare a detailed reconstruction estimate.

- Prepare a detailed inventory of personal property.

Step #6

Negotiations & Final Settlement

Our expert claim negotiators will work to make sure you receive the highest settlement possible under your specific insurance policy.

Step #7

Restoration | Reconstruction | Relocation

We negotiate with the insurance company to ensure that you can achieve your specific goals. Whether that’s full or partial restoration, rebuilding your property, or a full-relocation.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

FAQ

What Is A Public Claims Adjuster?

Imagine a public claims adjuster as the conductor of a symphony, orchestrating the harmonious blend of your insurance claim. Here at EastBay Adjusters, we specialize in steering through the complex world of insurance claims with finesse and expertise.

Just like a maestro leading a symphony, we skillfully guide your residential, commercial, or roofing insurance claim to a successful resolution.

- A public claims adjuster is like a skilled navigator, charting the course of your claim through turbulent waters.

- They are the guardian of your interests, ensuring that you receive fair and just compensation for your damages.

- Like a master craftsman, they meticulously piece together the puzzle of your claim, leaving no detail overlooked.

- A public claims adjuster is a beacon of light in the darkness of insurance complexities, guiding you towards a favorable outcome.

- They are the steadfast ally by your side, fighting tirelessly on your behalf to secure the best possible settlement.

At EastBay Adjusters, we recognize the importance of feeling supported and protected during the claims process. Join our community of satisfied clients who have found a sense of belonging and peace of mind in our expert care. Let us be your trusted partner in the journey towards a fair and just resolution for your insurance claim.

What Do Public Adjusters Do?

At EastBay Adjusters, we serve as the bridge between you and your insurance company, ensuring that your claims process flows smoothly like a river finding its way through a rocky terrain.

- Like skilled navigators, we guide you through the intricate maze of insurance policies and procedures.

- Just as expert craftsmen, we meticulously assess damages to your property with precision and care.

- Similar to diligent detectives, we uncover every detail to maximize your insurance claim.

- Much like trusted advisors, we provide support and reassurance every step of the way.

- Like loyal companions, we stand by your side to fight for the compensation you deserve.

When you choose EastBay Adjusters, you’re not just a client – you’re a valued member of our community. Let us help you navigate the complex world of insurance claims with ease and expertise.

Will My Settlement Be Larger If I Hire a Public Adjusting Company?

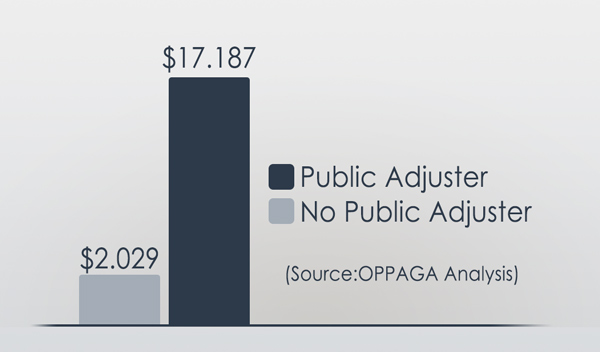

In most cases, yes, hiring a public adjusting firm can result in considerably larger settlement amounts, with recent studies showing a 800% higher settlement amount for policy holders who used a public adjuster.

At EastBay Adjusters, we recognize that maneuvering through insurance claims can feel like treading through a stormy sea. We are here to safely guide you through those choppy & confusing waters, and make sure you get what you are truly legally entitled to.

3 reasons why hiring a public adjusting company like EastBay Adjusters can lead to a larger settlement for your insurance claim:

- Expert Guidance: Our team of experienced public adjusters will navigate the complex waters of insurance claims on your behalf. We are experts when it comes to the ins-and-outs of the industry, and will guarantee that you receive the maximum settlement you deserve.

- Protecting Your Interests: We work tirelessly to make certain that your rights are upheld, and that you are not taken advantage of by the insurance company. Remember, the adjuster assigned to you by the insurance company is there to protect the insurance company’s interets, while a public adjuster is there to protect your interests.

- Maximizing Your Settlement: We will work diligently to maximize your settlement. Our expertise in evaluating damages, negotiating with insurance companies, and advocating for your rights will result in a larger settlement than if you were to navigate the claims process on your own.

So, if you’re wondering whether hiring a public adjusting company will lead to a larger settlement, the answer is a resounding yes nearly every time! Let EastBay Adjusters be the guiding light that leads you to a successful resolution of your insurance claim.

How Much Do Public Adjusters Charge?

Public adjuster fees varry by state, but typically range from 10%-20% of the total insurance settlement, depending on various factors such as the complexity of the claim and the adjuster’s experience. However, fees can go up to 30% for major or catostrophic claims that reqire months of work, and in most cases, an entire team of senior adjusters to be put on the case due to it’s complexity.

This fee structure is designed to align the interests of the adjuster and the policyholder, incentivizing public adjusters to maximize the settlement amount.

3 factors that influence the percentage charged by a public adjuster, include:

Claim Complexity: More complex claims, such as those involving extensive property damage or multiple types of losses, often warrant higher fees due to the extensive additional work, time, & team members required.

Experience and Reputation: Adjusters with a proven track record and significant experience may command higher fees, reflecting their expertise in guiding the claims process effectively.

Negotiation Skills: Skilled negotiators can secure higher settlements, justifying potentially higher fees based on the value they provide to the policyholder.

Understanding these fee structures is essential for policyholders considering hiring a public adjuster. It is important to weigh the potential benefits against the costs. For many, the expertise and advocacy provided by a public adjuster can lead to a substantially higher settlement, ultimately making the fee a worthwhile investment.

As you evaluate your options, consider not only the percentage but also the value of the services offered, ensuring you select a public adjuster who aligns with your needs and expectations.

How Are Public Adjusters Paid?

At EastBay Adjusters, we recognize the importance of clarity when it comes to payment for our services. As public adjusters specializing in residential, commercial, and roofing insurance claims, we aim to provide transparent and fair compensation structures for our clients.

Here’s A Breakdown Of How Public Adjusters Are Typically Paid:

- Contingency Fee Agreement:

This is the most common payment method used by public adjusters. Under a contingency fee agreement, the adjuster’s fee is contingent upon successfully negotiating a higher settlement for the client.

The fee is usually a percentage of the final settlement amount, typically ranging from 5% to 20%. This guarantees that our interests are aligned with yours, as we only get paid if we secure a better outcome for you.

- Hourly Rate:

Some public adjusters may opt to charge an hourly rate for their services. This method involves billing the client for the actual time spent working on the claim, whether it’s conducting inspections, gathering documentation, or communicating with the insurance company. While this may offer more transparency regarding billing, it can also lead to uncertainty about the total cost of the services provided.

- Fixed Fee:

In some cases, public adjusters may offer a fixed fee for their services. This means that the client pays a set amount for the adjuster’s assistance, regardless of the final settlement amount. This can provide predictability concerning costs, but it may not always align the adjuster’s interests with the client’s, as there is no incentive to negotiate a higher settlement.

At EastBay Adjusters, we believe in the power of a contingency fee agreement to guarantee that our clients receive the best possible outcome. Our goal is to maximize your insurance claim settlement while providing exceptional service every step of the way. Contact us today to learn more about how we can assist you with your insurance claim needs.

When Should You Hire A Public Adjuster?

When faced with the overwhelming task of maneuvering through insurance claims for your residential, commercial, or roofing property, it’s vital to reflect on when to bring in a professional public adjuster. At EastBay Adjusters, we recognize the complexities of insurance policies and the importance of maximizing your claim settlement.

Here are three key signs that indicate it’s time to hire a public adjuster:

- Overwhelmed with Documentation: If you find yourself drowning in paperwork, receipts, and policy details, it may be time to seek assistance. A public adjuster can help organize and streamline the documentation process, making certain that nothing is overlooked or missed.

- Disputed Claim Amounts: When the insurance company offers a settlement that seems inadequate or undervalued, it’s important to have a public adjuster on your side. They can negotiate on your behalf to secure a fair and accurate claim amount that reflects the true extent of your damages.

- Complex Claims Process: Insurance claims can be intricate and time-consuming, especially when dealing with multiple parties or extensive damage. A public adjuster can simplify the process, acting as your advocate and guiding you through each step to guarantee a successful outcome.

Remember, at EastBay Adjusters, we’re here to support you through every stage of your insurance claim. Reach out to us when you’re ready to experience the peace of mind that comes with expert guidance and support.

Can I Hire a Public Adjuster After Filing My Claim?

Yes, you can hire a public adjuster after claim filing. They’ll assist you in guiding insurance negotiations, ensuring you receive a fair settlement. Their expertise can greatly impact the outcome of your claim.

When Is It Too Late To Hire a Public Adjuster?

As the saying goes, ‘Better late than never’ – but when it comes to hiring a public adjuster, timing can be vital.

- Have you found yourself knee-deep in insurance claim paperwork after experiencing property damage?

- Are you feeling overwhelmed by the insurance claim process?

- Do you wish there was someone who could help you navigate through the complexities of filing a claim?

At EastBay Adjusters, we recognize the challenges that come with dealing with insurance claims for residential, commercial, or roofing damage. Our team of experienced public adjusters is here to help you every step of the way. Whether you’re just starting the claims process or feeling stuck in the middle, it’s never too late to reach out to us for assistance.

Imagine having someone by your side who knows the ins and outs of the insurance industry, someone who can advocate for you and guarantee that you receive the compensation you deserve. That’s where EastBay Adjusters comes in.

Don’t wait until it’s too late – contact us today and let us help you navigate the often confusing world of insurance claims. With EastBay Adjusters, you’ll never have to face the process alone.

How Long Does the Claims Process Usually Take With a Public Adjuster?

When you’re in the thick of it, the claims timeline can feel endless. With an adjuster’s involvement, you’ll navigate the process smoother, often reducing wait times and ensuring you get what you deserve faster.

Why should you hire a Public Adjuster if your insurance company has already assigned you an adjuster?

When your insurance company assigns you an adjuster, it’s crucial to understand that their loyalty lies with the company. In contrast, our licensed public adjusters are solely committed to representing you and your interests. This distinction is especially critical in cases of natural disasters like hurricanes.

Here’s why you should consider hiring a public adjuster:

- Advocacy: Our public adjusters act as your advocates in insurance claims, making sure that your best interests are prioritized.

- Increased Settlements: Studies show that claims managed with the help of a public adjuster result in settlements that are 700% higher for hurricane-related claims and over 500% higher for non-catastrophe-related claims compared to those negotiated directly between the policyholder and the insurance company.

- Expertise: Having a skilled public adjuster on your side can greatly influence the outcome of your insurance claim, leading to more favorable settlements.

- Peace of Mind: With a dedicated professional handling your claim, you can have peace of mind knowing that your interests are being actively pursued throughout the process.

The effectiveness and significance of hiring a public adjuster are clear. Don’t settle for less when it comes to your insurance claims – choose EastBay Adjusters to guarantee you get the best possible outcome.

Can I File My Insurance Claim Myself?

Filing an insurance claim on your own can be done, but it’s essential to contemplate if it’s the best choice. Insurance policies are often complicated and filled with jargon that can be difficult to grasp. This complexity might lead to misunderstandings or errors that could harm your claim.

Our expert Public Adjusters can assist you. They are industry professionals with the expertise and experience to effectively handle insurance policies and claims. Each team member comprehends the nuances of insurance documents and can smoothly guide you through the entire claims process.

With their expertise, EastBay Adjusters can advocate for you, ensuring your claim is presented in the best light possible. They excel at identifying and articulating the details of your claim that might otherwise be overlooked.

Their professional support can greatly impact the outcome of your claim, potentially resulting in a more favorable settlement compared to handling it on your own.

Although you have the choice to file a claim independently, due to the complexity of insurance policies and the potential for better outcomes, it is highly recommended to seek the assistance of our skilled and experienced Public Adjusters. Their expertise can be an essential asset in maneuvering through the claims process and achieving the best possible result.

3 Reasons To Choose EastBay Adjusters:

- Expertise in residential, commercial, and roofing insurance claims.

- Professional assistance in maneuvering insurance policies effectively.

- Advocacy for a more favorable settlement outcome.

Can My Contractor Represent Me Against My Insurance Company?

As a policyholder, it is vital to understand why your contractor cannot represent you against your insurance company. Our team of licensed Public Adjusters are the only professionals authorized to advocate for policyholders in the insurance claim process. This unique role allows them to work solely on your behalf, guiding you through the complexities of insurance claims with expertise and legal backing.

In Texas, it is illegal for contractors to act as public adjusters. This rule is strictly enforced to uphold the integrity of the insurance claim process and safeguard policyholders from potential conflicts of interest or unethical behavior. If you come across a contractor posing as a public adjuster, it is your right and duty to report this violation to the Texas Department of Insurance.

When reporting such misconduct, it is important to provide substantial evidence to support your claim. Solid proof is key to enabling the Texas Department of Insurance to investigate and address the issue effectively, ensuring compliance with the laws governing the conduct of public adjusters and contractors. By taking action, you play a part in maintaining a fair and lawful insurance claim environment, protecting your interests and those of other policyholders in Texas.

- Trust in our licensed Public Adjusters to represent you with expertise and legal authority.

- Uphold the integrity of the insurance claim process by reporting violations promptly.

- Provide concrete evidence to support your claim and enable effective investigation.

- Contribute to a fair and lawful insurance claim environment for all policyholders in Texas.

I Already Settled My Claim, But It Wasn’t Enough Money To Cover The Damages. Is It Too Late To Try To Get More Money?

If you settled your claim but didn’t receive enough money to cover the damages, it’s not too late to try and get more. Our team of expert Public Adjusters can help, even if the damage occurred within the past five years. We offer a free review of your claim to see if you’re eligible for additional compensation.

During this evaluation, our skilled Public Adjusters will carefully examine every detail of your original claim. They will assess the damage, your coverage, and how the claim was handled previously. This review aims to identify any areas where you were under-compensated or where there were oversights leading to the denial of your claim.

If our review shows you deserve more money, we will take action. Our team will negotiate with your insurance company on your behalf, using our expertise to guarantee you get what you’re owed. We recognize insurance policies and the tactics used by insurance companies, empowering us to fight for your rights and secure a fair outcome.

Our goal is to reduce the stress of dealing with insurance claims, especially if you feel mistreated by your insurance provider. We provide professional guidance and support throughout the process, working to get you the compensation you deserve. Don’t lose hope if your claim was initially underpaid or denied; our expert Public Adjusters are here to fight for you.

Can My Insurance Company Cancel My Contract If I Use a Public Adjuster?

No. Under existing laws and ethics that regulate the insurance industry, it is your LEGAL RIGHT to hire a certified public adjuster. Canceling your contract for excercising your right, would be considered a violation & is illegal. An insurance company cannot terminate your policy if you hire a public adjuster.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Get The HIGHEST & Most FAIR Settlement Amount Possible From Your Storm & Wind Damage Property Claim!

Get a free on-site inspection & insurance policy evaluation from one of our expert public claims adjusters!

Work with public insurance claim adjusters who are licensed, bonded, and trained to handle all residential or commercial insurance claims, big or small! Our public insurance adjusters’ technical and detailed expertise has satisfied countless homeowners, business owners, condominium management companies, and HOAs.

Our team of experts have years of experience dealing with insurance companies. Many of our public adjusters also have previous backgrounds in construction, giving us a significant advantage in quickly securing the most compensation for our clients. We know what to look for, what repairs actually cost, and what the insurance company’s adjusters tend to ignore (and hope you don’t know about!).

Our inspections are free, and we are 100% contingency-based, meaning we only get paid if you do!

We take pride in maintaining superior customer service and providing clear and friendly communication. Contact us to speak with one of our expert adjusters today!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

10 Storm & Wind Damage Homeowners Insurance Claims Tips

Public Adjusters For Storm & Wind Damage Insurance Claims

Learn how Storm & Wind Damage public adjusters can simplify your Storm & Wind Damage homeowners insurance claims process, and maximize your compensation, ensuring higher settlement opportunities.

Service Type: Public Adjusters For Storm & Wind Damage Insurance Claims

Price: 10-20%

Currency: USD

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.