Work With Trusted & Experienced

Ohio Public Adjusters That Work For You!

100% Contingency Based. We Don't Get Paid Unless YOU Get Paid!

Don’t Settle For Less!

Get The HIGHEST & Most FAIR Settlement Amount ... That You Are Legally Entitled To ... From Your Insurance Claim!

Get a free on-site inspection & insurance policy evaluation from one of our expert public claims adjusters!

Work with highly trained, & certified Ohio public insurance claim adjusters who are licensed, bonded, and trained to handle all residential or commercial insurance claims, big or small!

Our Ohio public adjusters have technical and detailed expertise, which has satisfied countless homeowners, business owners, condominium management companies, and HOAs.

Our team of insurance claim experts have years of experience dealing with insurance companies. Many of our public adjusters in Ohio also have previous backgrounds in construction and/or insurance, giving us a significant advantage in quickly securing the highest claim settlement compensation for our clients.

We know what to look for, what repairs actually cost, and what the insurance company’s adjusters tend to ignore (and hope you don’t know about!).

Our inspections are free, and we are 100% contingency-based, meaning we only get paid if you do!

We take pride in maintaining superior customer service and providing clear and friendly communication. Contact us to speak with one of our expert Ohio insurance claim adjusters today!

Request A Free Estimate!

- Required Fields

*Service May Not Be Available In All Areas. EastBay Adjusters aim is to provide you with as much information as possible to allow you to make an informed decision when hiring a public adjuster in Ohio, & help connect you with the right public insurance claims adjuster in Ohio for your specific claim needs. Our team of experts, & decades of experience in the field, allow us to match you with the ideal Ohio public insurance adjuster for your specialized needs. When you hire a public claims adjuster in Ohio through EastBay Adjusters, you get a qualified, licensed professional, who can help maximize your insurance claim settlement compensation.

Why Hire A Public Insurance Claims Adjuster In Ohio?

We Get You The HIGHEST & Most Fair Settlement Amount (That You Are Legally Entitled To) From Your Homeowners Insurance, Roofing, & Business Insurance Claims!

Get a Free On-Site Inspection & Insurance Policy Evaluation From One Of Our Expert Ohio Public Claims Adjusters!

- We Save You Time & Help Speed Up The Claim Process!

- We Help Alleviate Stress & Walk You Through The Whole Process

- We Negotiate With The Insurance Company & Make Sure You Get The Highest Settlement Possible

- We Prepare & File All The Necessary Documents, And Handle All The Necessary Follow-up's

What Our Expert Ohio Public Insurance Adjusters Bring To The Table

Ohio Insurance Policy Claims Specialists

Our experts have years of experience in claims & reviewing coverages. As such, we understand the numerous types of policies and endorsements in Ohio. Our expertise allows us to find & utalize the various coverages your policy may have, and in many cases, inform you of coverage & clauses you may not even know about.

Advocates For Ohio Homeonwers Insurance Policy Holders

We advocate for your rights as the policy holder. We ensure that our clients’ rights are being protected throughout the claims process, and make sure you get all the benefits you are entitled to based on your policy. Our team of expert public claims adjusters in Ohio will be there with you every step of the way!

Experts In Seen & Unseen Damages

Our Ohio based public insurance claims adjusters have years of experience identifying damage, and in most cases, come from professional construction, roofing, and insurance backgrounds. As such, we are able to find & isolate damages that you may not even know to look for, or know would/should be covered by your policy! We also incorporate the latest assessment techniques & technology when conducting our property inspections.

Expert Negotiators

Settlement negotiation is critically important when it comes to the claims process in Ohio. We know how the insurance companies think, and come to the negotiation table fully prepared to make sure they know, that we know. Our expertise and experience in claims negotiations ensures that you get what you are actually entitled to under your policy ... not what the insurance company tells you that you are, based on their own interests. When the insurance company plays hardball or puts up a fight, we aren't afraid to get in that ring and fight them for what's rightfully yours!

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Learn more about what our expert public adjusters can do for your residential insurance claims!

Learn about what our expert public adjusters can do for your commercial insurance claims!

Learn about what our public adjusting roofing specialists can do for you & your roofing claims!

Insurance adjusters work for THEM, our public adjusters work for YOU! Here’s how …

Frequently Asked Questions (FAQ) About Ohio Public Adjusting

What Is A Public Adjuster In Ohio?

Imagine a Ohio public claims adjuster as the conductor of a symphony, orchestrating the numerous moving parts & players involved in securing your insurance claim benefits. Here at EastBay Adjusters, we specialize in steering through the complex world of insurance claims with expertise, & speed.

Just like a maestro leading a symphony, we skillfully guide your residential, commercial, or roofing insurance claim to a successful resolution!

- Ohio public claims adjusters are like skilled navigators, charting the course of your claim through turbulent waters, and helping policy holders avoid the pitfalls & roadblocks they don’t know to look out for.

- They are the guardian of your interests, ensuring that you receive fair and just compensation for your damages.

- Like a master craftsman, they meticulously piece together the puzzle of your claim, leaving no detail overlooked.

- A Ohio public claims adjuster is a beacon of light in the darkness of insurance complexities, guiding you towards a favorable outcome.

- They are the steadfast ally standing by your side, fighting tirelessly on your behalf to secure the highest settlement.

At EastBay Adjusters, we recognize the importance of feeling supported and protected during the claims process. Join our community of satisfied clients who have found a sense of protection, and peace of mind, in our expert care. Let us be your trusted partner & ally in the journey towards a fair and just resolution for your insurance claim.

What Do Ohio Public Adjusters Do?

At EastBay Adjusters, we serve as the bridge between you and your insurance company, ensuring that your claims process flows smoothly through an otherwise rocky & uncertain terrain.

- Like skilled navigators, we guide you through the intricate maze of insurance policies and procedures.

- Just as expert craftsmen, we meticulously assess damages to your property with precision and care.

- Similar to diligent detectives, we uncover every detail to maximize your insurance claim.

- Much like trusted advisors, we provide support and reassurance every step of the way.

- Like loyal companions, we stand by your side to fight for the compensation you deserve.

When you choose EastBay Adjusters, you’re not just a client – you’re a valued member of our community. Let us help you navigate the complex world of insurance claims with ease and expertise.

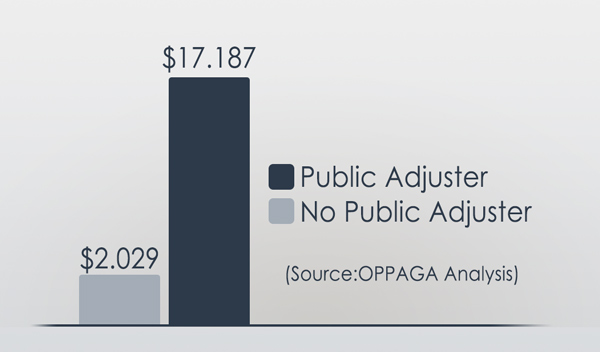

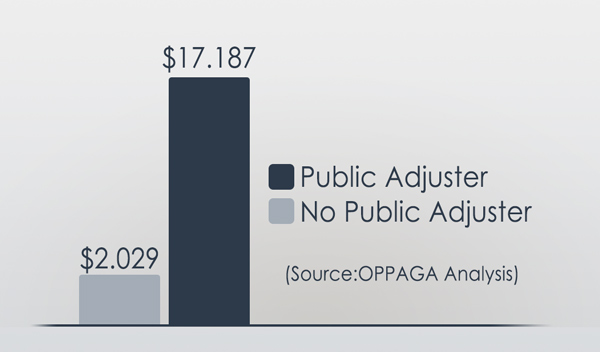

Will My Settlement Be Larger If I Hire A Ohio Public Adjusting Company?

In most insurance claim cases in Ohio, yes, hiring a Ohio public adjusting firm can result in considerably larger settlement amounts, with recent studies showing an 800% higher settlement amount for policy holders who used a Ohio public adjuster.

At EastBay Adjusters, we recognize that maneuvering through insurance claims can feel like treading through a stormy sea. We are here to safely guide you through those choppy & confusing waters, and make sure you get what you are truly legally entitled to.

3 reasons why hiring a public adjusting company like EastBay Adjusters can lead to a larger settlement for your insurance claim:

- Expert Guidance: Our team of experienced public adjusters will navigate the complex waters of insurance claims on your behalf. We are experts when it comes to the ins-and-outs of the industry, and will guarantee that you receive the maximum settlement you deserve.

- Protecting Your Interests: We work tirelessly to make certain that your rights are upheld, and that you are not taken advantage of by the insurance company. Remember, the adjuster assigned to you by the insurance company is there to protect the insurance company’s interets, while a public adjuster is there to protect your interests.

- Maximizing Your Settlement: We will work diligently to maximize your settlement. Our expertise in evaluating damages, negotiating with insurance companies, and advocating for your rights will result in a larger settlement than if you were to navigate the claims process on your own.

So, if you’re wondering whether hiring a public adjusting company will lead to a larger settlement, the answer is a resounding yes nearly every time! Let EastBay Adjusters be the guiding light that leads you to a successful resolution of your insurance claim.

How Much Do Ohio Public Adjusters Charge?

Public adjuster fees varry by state, but typically range from 10%-20% of the total insurance settlement, depending on various factors such as the complexity of the claim and the adjuster’s experience. However, fees can go up to 30% for major or catostrophic claims that reqire months of work, and in most cases, an entire team of senior adjusters to be put on the case due to it’s complexity.

This fee structure is designed to align the interests of the adjuster and the policyholder, incentivizing public adjusters to maximize the settlement amount.

3 factors that influence the percentage charged by a public adjuster, include:

Claim Complexity: More complex claims, such as those involving extensive property damage or multiple types of losses, often warrant higher fees due to the extensive additional work, time, & team members required.

Experience and Reputation: Adjusters with a proven track record and significant experience may command higher fees, reflecting their expertise in guiding the claims process effectively.

Negotiation Skills: Skilled negotiators can secure higher settlements, justifying potentially higher fees based on the value they provide to the policyholder.

Understanding these fee structures is essential for policyholders considering hiring a public adjuster. It is important to weigh the potential benefits against the costs. For many, the expertise and advocacy provided by a public adjuster can lead to a substantially higher settlement, ultimately making the fee a worthwhile investment.

As you evaluate your options, consider not only the percentage but also the value of the services offered, ensuring you select a public adjuster who aligns with your needs and expectations.

How Are Ohio Public Insurance Claim Adjusters Paid?

At EastBay Adjusters, we recognize the importance of clarity when it comes to payment for our services. As public adjusters specializing in residential, commercial, and roofing insurance claims, we aim to provide transparent and fair compensation structures for our clients.

Here’s A Breakdown Of How Public Adjusters Are Typically Paid:

- Contingency Fee Agreement:

This is the most common payment method used by public adjusters. Under a contingency fee agreement, the adjuster’s fee is contingent upon successfully negotiating a higher settlement for the client.

The fee is usually a percentage of the final settlement amount, typically ranging from 5% to 20%. This guarantees that our interests are aligned with yours, as we only get paid if we secure a better outcome for you.

- Hourly Rate:

Some public adjusters may opt to charge an hourly rate for their services. This method involves billing the client for the actual time spent working on the claim, whether it’s conducting inspections, gathering documentation, or communicating with the insurance company. While this may offer more transparency regarding billing, it can also lead to uncertainty about the total cost of the services provided.

- Fixed Fee:

In some cases, public adjusters may offer a fixed fee for their services. This means that the client pays a set amount for the adjuster’s assistance, regardless of the final settlement amount. This can provide predictability concerning costs, but it may not always align the adjuster’s interests with the client’s, as there is no incentive to negotiate a higher settlement.

At EastBay Adjusters, we believe in the power of a contingency fee agreement to guarantee that our clients receive the best possible outcome. Our goal is to maximize your insurance claim settlement while providing exceptional service every step of the way. Contact us today to learn more about how we can assist you with your insurance claim needs.

When Should You Hire A Public Claims Adjuster In Ohio?

When faced with the overwhelming task of maneuvering through insurance claims for your residential, commercial, or roofing property, it’s vital to reflect on when to bring in a professional public adjuster. At EastBay Adjusters, we recognize the complexities of insurance policies and the importance of maximizing your claim settlement.

Here are three key signs that indicate it’s time to hire a public adjuster:

- Overwhelmed with Documentation: If you find yourself drowning in paperwork, receipts, and policy details, it may be time to seek assistance. A public adjuster can help organize and streamline the documentation process, making certain that nothing is overlooked or missed.

- Disputed Claim Amounts: When the insurance company offers a settlement that seems inadequate or undervalued, it’s important to have a public adjuster on your side. They can negotiate on your behalf to secure a fair and accurate claim amount that reflects the true extent of your damages.

- Complex Claims Process: Insurance claims can be intricate and time-consuming, especially when dealing with multiple parties or extensive damage. A public adjuster can simplify the process, acting as your advocate and guiding you through each step to guarantee a successful outcome.

Remember, at EastBay Adjusters, we’re here to support you through every stage of your insurance claim. Reach out to us when you’re ready to experience the peace of mind that comes with expert guidance and support.

How Long Does An Insurance Company Have To Investigate A Claim In Ohio?

In Ohio, homeowners who file a claim with their insurance company can expect a prompt and thorough investigation within a reasonable timeframe. According to Ohio law, insurance companies have a specific deadline to investigate a homeowners insurance claim. Within 15 business days of receiving a claim, the insurer must acknowledge receipt of the claim and begin the investigation process. The insurer is then required to conduct a thorough and objective investigation to determine the extent of the loss and the policyholder’s entitlement to benefits. This investigation typically involves assessing the damage, reviewing policy terms, and gathering evidence to support the claim. In most cases, the investigation should be completed within 30 business days from the date the claim was filed. However, this timeframe may be extended if the insurer requires additional information or documentation from the policyholder or if the claim is particularly complex. It’s essential for policyholders to stay informed and engaged throughout the investigation process, ensuring that their claim is handled efficiently and fairly. If the insurer fails to meet these deadlines or unreasonably delays the investigation, policyholders may be entitled to seek assistance from the Ohio Department of Insurance. By understanding the investigation process and timelines, homeowners in Ohio can navigate their insurance claims with confidence, knowing their rights and expectations are protected.

What To Do If Insurance Company Is Stalling In Ohio?

If your homeowners insurance company is stalling in Ohio, it’s essential to know that you have options to expedite the claims process and secure a fair settlement. Dealing with an uncooperative insurance company can be frustrating and stressful, especially when you’re trying to recover from a disaster or unexpected event. In Ohio, insurance companies are required to investigate and settle claims in a timely manner. However, sometimes insurers may delay or deny claims, leaving homeowners feeling helpless and unsure of what to do next. This is where a public adjuster can play a vital role. A public adjuster is a licensed professional who represents policyholders, not insurance companies, and can help navigate the complex claims process. They possess in-depth knowledge of Ohio’s insurance laws and regulations, ensuring that your rights as a policyholder are protected. By hiring a public adjuster, you can level the playing field and counterbalance the insurance company’s adjuster, who often prioritizes the insurer’s interests. A public adjuster can assist in documenting damages, preparing and submitting claims, negotiating with the insurance company, and advocating on your behalf. With their expertise, you can increase the likelihood of a fair and prompt settlement, which is crucial in getting your life back to normal. If you’re facing resistance from your homeowners insurance company in Ohio, consider consulting a public adjuster to ensure your rights are protected and your claim is handled efficiently.

When Is It Too Late To Hire A Ohio Public Adjuster?

As the saying goes, ‘Better late than never’ – but when it comes to hiring a public adjuster, timing can be vital.

- Have you found yourself knee-deep in insurance claim paperwork after experiencing property damage?

- Are you feeling overwhelmed by the insurance claim process?

- Do you wish there was someone who could help you navigate through the complexities of filing a claim?

At EastBay Adjusters, we recognize the challenges that come with dealing with insurance claims for residential, commercial, or roofing damage. Our team of experienced public adjusters is here to help you every step of the way. Whether you’re just starting the claims process or feeling stuck in the middle, it’s never too late to reach out to us for assistance.

Imagine having someone by your side who knows the ins and outs of the insurance industry, someone who can advocate for you and guarantee that you receive the compensation you deserve. That’s where EastBay Adjusters comes in.

Don’t wait until it’s too late – contact us today and let us help you navigate the often confusing world of insurance claims. With EastBay Adjusters, you’ll never have to face the process alone.

Why should you hire a Public Insurance Claims Adjuster In Ohio if your insurance company has already assigned you an adjuster?

When your insurance company assigns you an adjuster, it’s crucial to understand that their adjuster’s loyalty lies with the insurance company. In contrast, our Ohio based licensed public adjusters are solely committed to representing you and your interests. This distinction is especially critical in cases of natural disasters like hurricanes.

Here’s why you should consider hiring a public adjuster in Ohio:

- Advocacy: Our public adjusters act as your advocates in insurance claims, making sure that your best interests are prioritized.

- Increased Settlements: Studies show that claims managed with the help of a public adjuster result in settlements that are 700% higher for hurricane-related claims and over 500% higher for non-catastrophe-related claims compared to those negotiated directly between the policyholder and the insurance company.

- Expertise: Having a skilled public adjuster on your side can greatly influence the outcome of your insurance claim, leading to more favorable settlements.

- Peace of Mind: With a dedicated professional handling your claim, you can have peace of mind knowing that your interests are being actively pursued throughout the process.

The effectiveness and significance of hiring a public adjuster are clear. Don’t settle for less when it comes to your insurance claims – choose EastBay Adjusters to guarantee you get the best possible outcome.

Can I File My Insurance Claim Myself?

Filing an insurance claim on your own can be done, but it’s essential to contemplate if it’s the best choice. Insurance policies are often complicated and filled with jargon that can be difficult to grasp. This complexity might lead to misunderstandings or errors that could harm your claim.

Our expert Public Adjusters can assist you. They are industry professionals with the expertise and experience to effectively handle insurance policies and claims. Each team member comprehends the nuances of insurance documents and can smoothly guide you through the entire claims process.

With their expertise, EastBay Adjusters can advocate for you, ensuring your claim is presented in the best light possible. They excel at identifying and articulating the details of your claim that might otherwise be overlooked.

Their professional support can greatly impact the outcome of your claim, potentially resulting in a more favorable settlement compared to handling it on your own.

Although you have the choice to file a claim independently, due to the complexity of insurance policies and the potential for better outcomes, it is highly recommended to seek the assistance of our skilled and experienced Public Adjusters. Their expertise can be an essential asset in maneuvering through the claims process and achieving the best possible result.

3 Reasons To Choose EastBay Adjusters:

- Expertise in residential, commercial, and roofing insurance claims.

- Professional assistance in maneuvering insurance policies effectively.

- Advocacy for a more favorable settlement outcome.

Can My Contractor Represent Me Against My Insurance Company?

As a policyholder, it is vital to understand why your contractor cannot represent you against your insurance company. Our team of licensed Public Adjusters in Ohio are the only professionals authorized to advocate for policyholders in the insurance claim process. This unique role allows them to work solely on your behalf, guiding you through the complexities of insurance claims with expertise and legal backing.

In Ohio, it is illegal for contractors to act as public adjusters. This rule is strictly enforced to uphold the integrity of the insurance claim process and safeguard policyholders from potential conflicts of interest or unethical behavior. If you come across a contractor posing as a public adjuster, it is your right and duty to report this violation to the Ohio Department of Insurance.

When reporting such misconduct, it is important to provide substantial evidence to support your claim. Solid proof is key to enabling the Ohio Department of Insurance to investigate and address the issue effectively, ensuring compliance with the laws governing the conduct of public adjusters and contractors. By taking action, you play a part in maintaining a fair and lawful insurance claim environment, protecting your interests and those of other policyholders in Ohio.

- Trust in our licensed Public Adjusters to represent you with expertise and legal authority.

- Uphold the integrity of the insurance claim process by reporting violations promptly.

- Provide concrete evidence to support your claim and enable effective investigation.

- Contribute to a fair and lawful insurance claim environment for all policyholders in Ohio.

I Already Settled My Claim, But It Wasn’t Enough Money To Cover The Damages. Is It Too Late To Try To Get More Money?

If you settled your claim but didn’t receive enough money to cover the damages, it’s not too late to try and get more. Our team of expert Public Adjusters can help, even if the damage occurred within the past five years. We offer a free review of your claim to see if you’re eligible for additional compensation.

During this evaluation, our skilled Public Adjusters will carefully examine every detail of your original claim. They will assess the damage, your coverage, and how the claim was handled previously. This review aims to identify any areas where you were under-compensated or where there were oversights leading to the denial of your claim.

If our review shows you deserve more money, we will take action. Our team will negotiate with your insurance company on your behalf, using our expertise to guarantee you get what you’re owed. We recognize insurance policies and the tactics used by insurance companies, empowering us to fight for your rights and secure a fair outcome.

Our goal is to reduce the stress of dealing with insurance claims, especially if you feel mistreated by your insurance provider. We provide professional guidance and support throughout the process, working to get you the compensation you deserve. Don’t lose hope if your claim was initially underpaid or denied; our expert Public Adjusters are here to fight for you.

Can My Insurance Company Cancel My Contract If I Use a Public Adjuster In Ohio?

No. Under existing laws and ethics that regulate the insurance industry, it is your LEGAL RIGHT to hire a certified public adjuster in Ohio. Canceling your contract for excercising your right, would be considered a violation & is illegal. An insurance company cannot terminate your policy if you hire a public adjuster.

What Is The Average Deductible For Roof Replacement In Ohio?

The average deductible for roof replacement in Ohio can vary significantly depending on several factors, including the type of insurance policy, the age and condition of the roof, and the insurance provider. However, based on industry estimates, the average deductible for roof replacement in Ohio ranges from $1,000 to $5,000. For homeowners with a standard homeowners’ insurance policy, the deductible is typically a flat rate or a percentage of the total claim amount, usually ranging from 1% to 5% of the insured value of the home. For example, if a homeowner’s insurance policy has a 2% deductible and the insured value of the home is $200,000, the deductible would be $4,000. In Ohio, roof replacement costs can be quite high, with the average cost ranging from $8,000 to $15,000 or more, depending on the size, material, and complexity of the roof. As such, homeowners should carefully review their insurance policies and deductibles to ensure they have adequate coverage to meet the costs of roof replacement in the event of damage or loss. It’s also essential to consult with a licensed insurance professional or roofing expert to gain a better understanding of the average deductible for roof replacement in Ohio and to determine the best course of action for individual circumstances.

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

The Homeowners Insurance Claims Recovery Process In Ohio

Our licensed public adjusters are fluent in “Insurance Policy Jargon”, and will guide you through the entire property insurance claims process, while we fight to make sure you get the highest compensation possible for your claim!

Step #1

Make Sure Your Family Is Safe

When disaster strikes, the priority is to make sure your family is safe. Always have an emergency bag!

Step #2

Contact Our Public Adjusters In Ohio

Contact one of our expert certified public insurance adjusters to schedule an appointment for us to come out & meet with you to inspect the damage.

Step #3

Thorough Review Of Your Policy

One of our claims specialists will conduct a comprehensive review of your policy, note any coverage restrictions, coinsurance requirements, limitations, and review additional options that may be available to you.

Step #4

Create A Claims Strategy That Works For Your Specific Goals & Needs

We’ll discuss what is most important to you when it comes to your claim, then create & tailor the right claims strategy to take care of your family.

Step #5

We Take Care Of All Insurance Related Paperwork, Negotiations, & Follow Up.

Once we have agreed on a strategy, our specialists will:

- Meet with insurance company adjusters & personnel at the loss/damage location.

- Agree to the scope of damages & make sure that they are including all the damages in the scope, as well as clearly deciding on what should be repaired vs. replaced.

- Prepare a detailed reconstruction estimate.

- Prepare a detailed inventory of personal property.

Step #6

Negotiations & Final Settlement

Our expert claim negotiators will work to make sure you receive the highest settlement possible under your specific insurance policy.

Step #7

Restoration | Reconstruction | Relocation

We negotiate with the insurance company to ensure that you can achieve your specific goals. Whether that’s full or partial restoration, rebuilding your property, or a full-relocation.

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Discover How Ohio Public Claims Adjusters Can Get You More From These Types Of Homeowners Insurance Claims

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Find A Public Adjuster In Ohio Near You In One Of These Cities That We Service:

- Public Adjuster Akron Ohio

- Public Adjuster Canton Ohio

- Public Adjuster Cincinnati Ohio

- Public Adjuster Cleveland Ohio

- Public Adjuster Columbus Ohio

- Public Adjuster Dayton Ohio

- Public Adjuster Elyria Ohio

- Public Adjuster Hamilton Ohio

- Public Adjuster Kettering Ohio

- Public Adjuster Lakewood Ohio

- Public Adjuster Lorain Ohio

- Public Adjuster Parma Ohio

- Public Adjuster Poznan Ohio

- Public Adjuster Springfield Ohio

- Public Adjuster Toledo Ohio

- Public Adjuster Youngstown Ohio

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Can You Be A Public Adjuster And An Independent Adjuster?

Public Adjuster Vs All Lines Adjuster

Private Adjuster Vs Public Adjuster

Public Adjuster Vs Attorney

Insurance Adjuster Vs. Attorney

Public Adjuster Vs Appraiser

Public Adjuster Vs Insurance Adjuster

Public Adjuster Vs Independent Adjuster

Appraiser Vs Adjuster

Inspector Vs Appraiser

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

More About Ohio

Ohio | |

|---|---|

State | |

Flag  Seal | |

| Nicknames: The Buckeye State; Birthplace of Aviation; The Heart of It All | |

| Motto: “With God, all things are possible” | |

| Anthem: “Beautiful Ohio” | |

Map of the United States with Ohio highlighted | |

| Country | United States |

| Admitted to the Union | March 1, 1803; 221 years ago (1803-03-01) (17th, declared retroactively on August 7, 1953; 71 years ago (1953-08-07)) |

| Capital (and largest city) | Columbus |

| Largest county or equivalent | Franklin |

| Largest metro and urban areas | Greater Cleveland (combined and urban) Cincinnati (metro) Columbus (metro) (see footnotes) |

| Government | |

| • Governor | Mike DeWine (R) |

| • Lieutenant Governor | Jon Husted (R) |

| Legislature | General Assembly |

| • Upper house | Senate |

| • Lower house | House of Representatives |

| Judiciary | Supreme Court of Ohio |

| U.S. senators | Sherrod Brown (D) JD Vance (R) |

| U.S. House delegation | 10 Republicans 5 Democrats (list) |

| Area | |

| • Total | 44,825 sq mi (116,096 km) |

| • Land | 40,948 sq mi (106,156 km) |

| • Water | 3,877 sq mi (10,040 km) 8.7% |

| • Rank | 34th |

| Dimensions | |

| • Length | 220 mi (355 km) |

| • Width | 220 mi (355 km) |

| Elevation | 850 ft (260 m) |

| Highest elevation (Campbell Hill) | 1,549 ft (472 m) |

| Lowest elevation (Ohio River at Indiana border) | 455 ft (139 m) |

| Population (2023) | |

| • Total | 11,785,935 |

| • Rank | 7th |

| • Density | 282/sq mi (109/km) |

| • Rank | 10th |

| • Median household income | $54,021 |

| • Income rank | 36th |

| Demonym(s) | Ohioan; Buckeye (colloq.) |

| Language | |

| • Official language | De jure: None De facto: English |

| • Spoken language | English 93.3% Spanish 2.2% Other 4.5% |

| Time zone | UTC– 05:00 (Eastern) |

| • Summer (DST) | UTC– 04:00 (EDT) |

| USPS abbreviation | OH |

| ISO 3166 code | US-OH |

| Traditional abbreviation | O., Oh. |

| Latitude | 38°24′ N to 41°59′ N |

| Longitude | 80°31′ W to 84°49′ W |

| Website | ohio |

| List of state symbols | |

|---|---|

Flag of Ohio | |

Seal of Ohio | |

| Slogan | The Heart Of It All |

| Living insignia | |

| Amphibian | Spotted salamander |

| Bird | Cardinal (1933) |

| Flower |

|

| Fruit | Pawpaw |

| Insect | Ladybug (1975) |

| Mammal | White-tailed deer (1987) |

| Reptile | Black racer snake (1995) |

| Tree | Buckeye (1953) |

| Inanimate insignia | |

| Beverage | Tomato juice (1965) |

| Fossil | Isotelus maximus, a trilobite (1985) |

| Gemstone | Ohio flint (1965) |

| State route marker | |

| |

| State quarter | |

Released in 2002 | |

| Lists of United States state symbols | |

Ohio ( oh-HY-oh) is a state in the Midwestern region of the United States. It borders Lake Erie to the north, Pennsylvania to the east, West Virginia to the southeast, Kentucky to the southwest, Indiana to the west, and Michigan to the northwest. Of the 50 U.S. states, it is the 34th-largest by area. With a population of nearly 11.8 million, Ohio is the seventh-most populous and tenth-most densely populated state. Its capital and most populous city is Columbus, with other large population centers including Cleveland, Cincinnati, Dayton, Akron, and Toledo. Ohio is nicknamed the “Buckeye State” after its Ohio buckeye trees, and Ohioans are also known as “Buckeyes”. Its flag is the only non-rectangular flag of all U.S. states.

Ohio derives its name from the Ohio River that forms its southern border, which, in turn, originated from the Seneca word ohiːyo’, meaning “good river”, “great river”, or “large creek”. The state was home to several ancient indigenous civilizations, with humans present as early as 10,000 BCE. It arose from the lands west of the Appalachian Mountains that were contested by various native tribes and European colonists from the 17th century through the Northwest Indian Wars of the late 18th century. Ohio was partitioned from the Northwest Territory, the first frontier of the new United States, becoming the 17th state admitted to the Union on March 1, 1803, and the first under the Northwest Ordinance. It was the first post-colonial free state admitted to the union and became one of the earliest and most influential industrial powerhouses during the 20th century. Although it has transitioned to a more information- and service-based economy in the 21st century, it remains an industrial state, ranking seventh in GDP as of 2019, with the third-largest manufacturing sector and second-largest automobile production.

Modeled on its federal counterpart, Ohio’s government is composed of the executive branch, led by the governor; the legislative branch, consisting of the bicameral Ohio General Assembly; and the judicial branch, led by the state Supreme Court. Ohio occupies 15 seats in the United States House of Representatives, the seventh-largest delegation. Seven presidents of the United States have come from Ohio, earning it the moniker “the Mother of Presidents”.

SourcePublic Adjusters For Homeowners Insurance Claims

Public adjusters can simplify your homeowners insurance claims process, and maximize your compensation, ensuring higher settlement opportunities.

Service Type: Public Adjusting

Price: 10-20%

Currency: USD

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.